Navigating the world of Medicare can be complex, especially when it comes to understanding supplemental coverage. At Dave Silver Insurance, we often hear the question: “What does Medigap insurance cover?”

This comprehensive guide will break down the core benefits and additional coverage options provided by Medigap policies. We’ll explore how these plans fill the gaps in Original Medicare, ensuring you have a clear picture of your healthcare coverage options.

What Is Medigap Insurance?

The Basics of Medigap

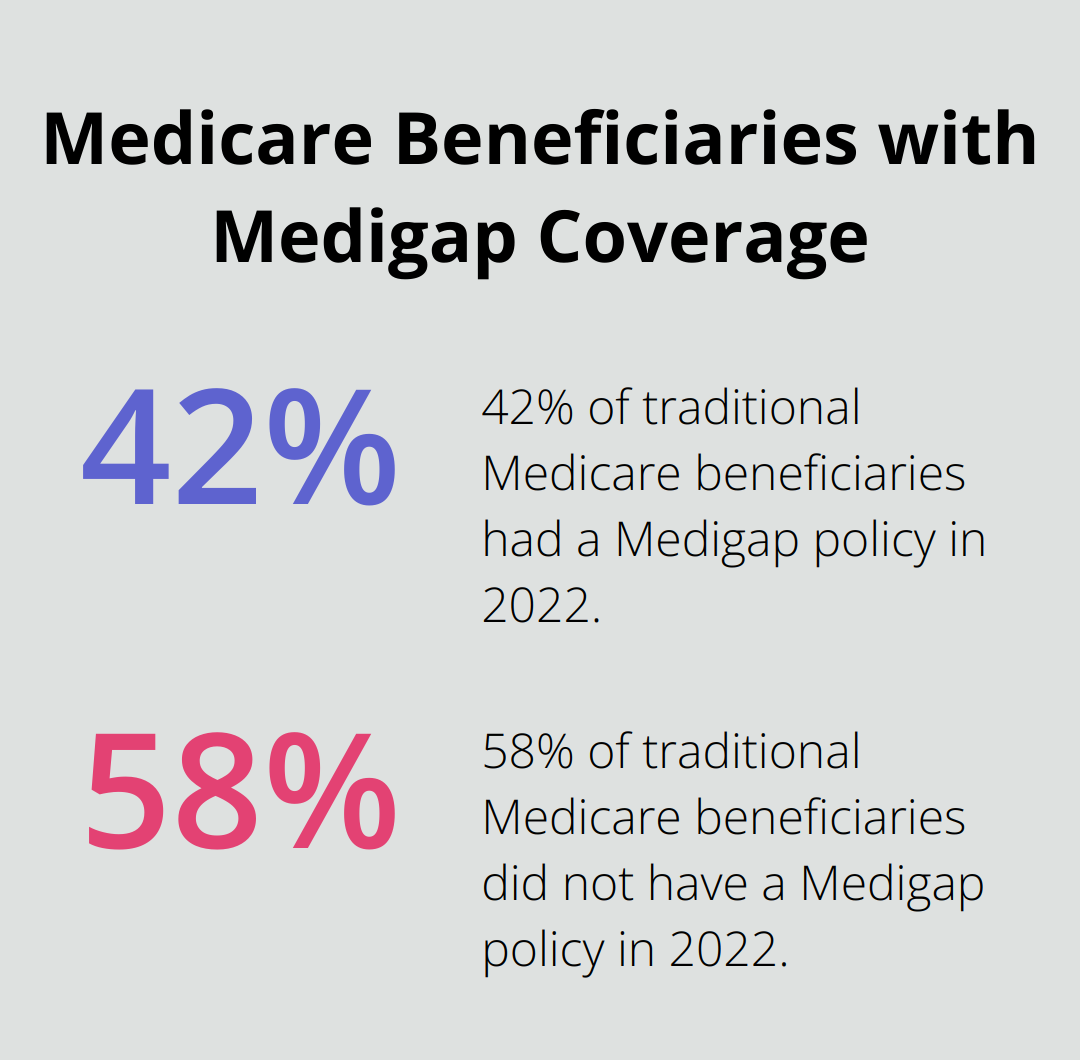

Medigap insurance (also known as Medicare Supplement Insurance) generally helps cover your share of costs for services that are covered by Original Medicare (Part A and Part B). Private insurance companies sell these policies, which work alongside Original Medicare. Medigap helps cover expenses such as deductibles, copayments, and coinsurance that Original Medicare doesn’t pay for. The Centers for Medicare & Medicaid Services (CMS) reported that in 2022, 12.5 million Medicare beneficiaries (42% of traditional Medicare beneficiaries) had a Medigap policy.

Complementing Original Medicare

Original Medicare provides essential coverage for hospital stays (Part A) and medical services (Part B), but leaves beneficiaries responsible for significant out-of-pocket costs. Medigap addresses this issue. For instance, if you have a hospital stay, Original Medicare might cover 80% of the approved amount. A Medigap policy can cover the remaining 20% coinsurance, potentially saving you thousands of dollars.

Financial Impact

The Kaiser Family Foundation reports that traditional Medicare beneficiaries with Medigap are less likely to report cost-related problems compared to those without supplemental coverage. This financial protection proves especially important for seniors on fixed incomes. In 2023, the average monthly premium for Medigap policies was $217. While this represents an additional cost, many find that this investment leads to significant savings over time.

Standardized Plans

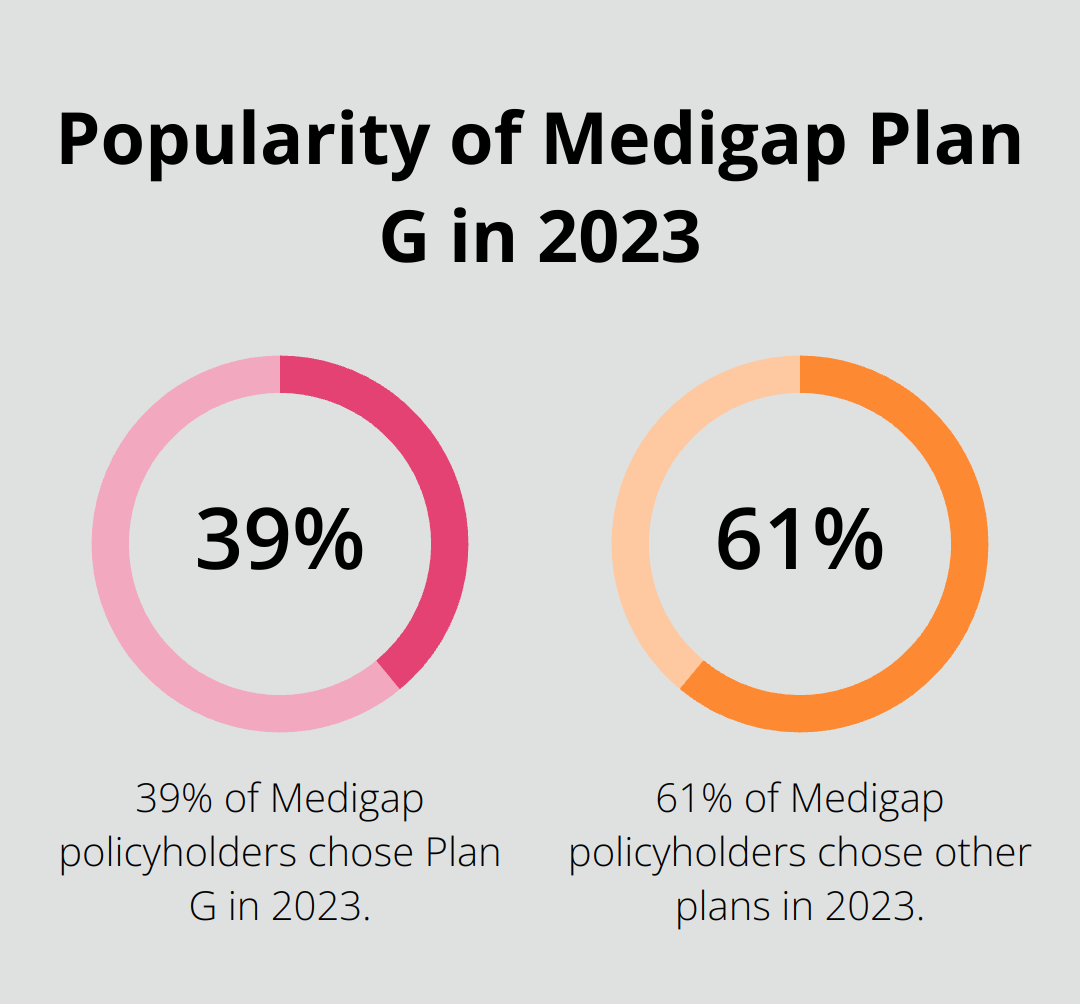

Medigap offers ten standardized plans (labeled A through N). Each plan provides a different level of coverage, allowing beneficiaries to choose the option that best suits their needs and budget. Plan G, for example, was the most popular plan in 2023, accounting for 39% of policyholders. This plan helps cover all cost-sharing for Medicare services except the Part B deductible.

Enrollment Considerations

The best time to enroll in a Medigap policy is during your open enrollment period, which starts when you turn 65 and are enrolled in Medicare Part B. This six-month window provides guaranteed issue rights, meaning insurance companies cannot deny you coverage or charge higher premiums based on your health status.

As we move forward, we’ll explore the specific benefits covered by Medigap policies, helping you understand how these plans can enhance your overall healthcare coverage.

What Core Benefits Does Medigap Cover?

Hospital Costs and Extended Coverage

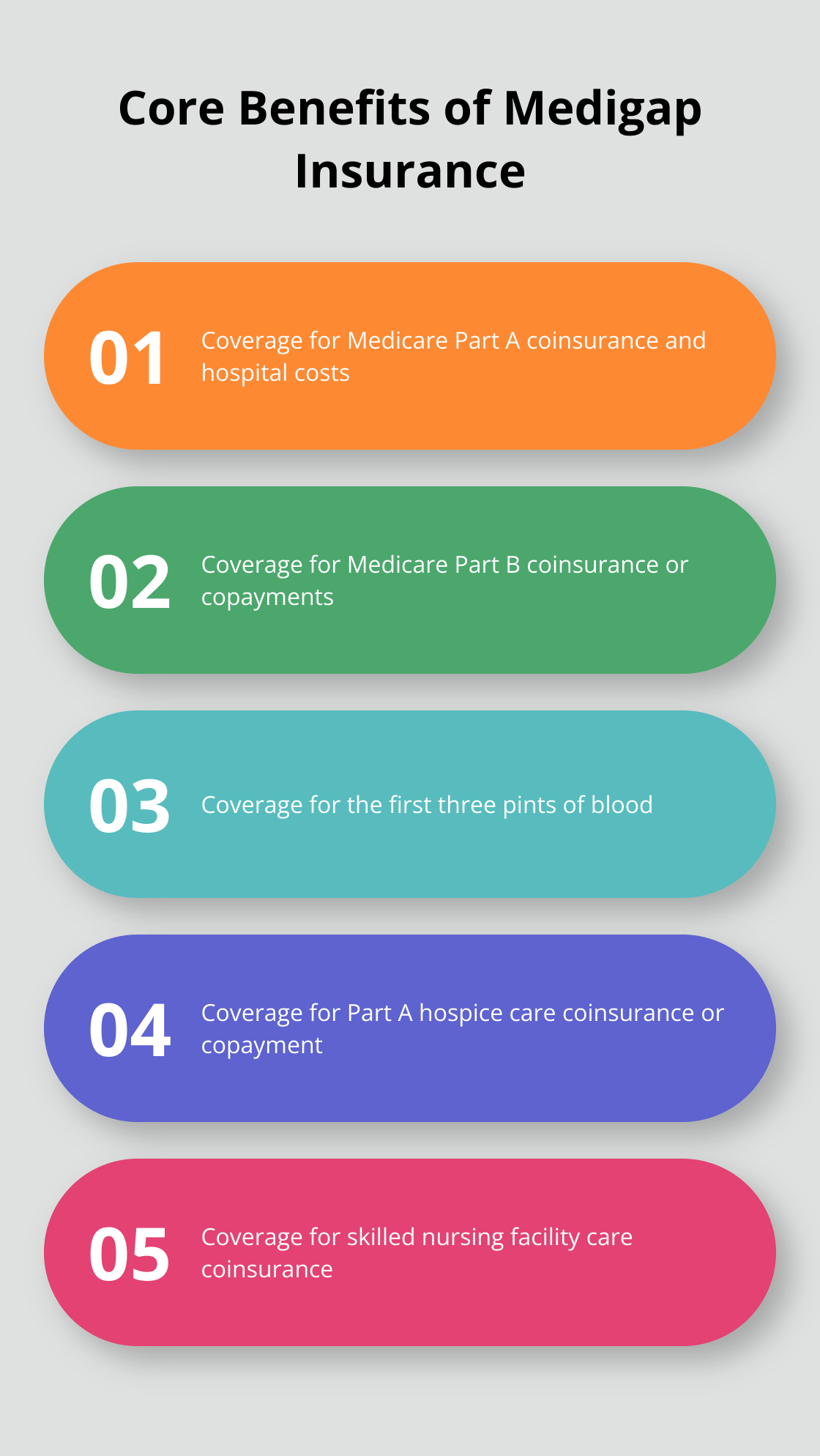

Medigap insurance offers a range of core benefits that enhance your Medicare coverage. These benefits fill the gaps in Original Medicare, providing more comprehensive healthcare protection.

One of the primary benefits of Medigap is its coverage of Medicare Part A coinsurance and hospital costs. A coinsurance cost applies after day 60 of the hospital stay. After day 90, the costs become at least partly the responsibility of the individual. Medigap provides an additional 365 days of hospital coverage after your Medicare benefits end. This extended coverage can save you thousands of dollars if you face prolonged hospitalizations.

Outpatient Expenses and Blood Coverage

Medigap also covers Medicare Part B coinsurance or copayments. This benefit applies to doctor visits, outpatient services, and durable medical equipment. Additionally, Medigap covers the cost of the first three pints of blood you might need during a medical procedure. While this might seem minor, the cost of blood can be substantial (often $200 to $300 per unit).

End-of-Life and Skilled Nursing Care

Part A hospice care coinsurance or copayment is another important benefit covered by Medigap. This coverage ensures that you or your loved ones receive necessary end-of-life care without financial worry. Moreover, Medigap covers the coinsurance for skilled nursing facility care. This benefit can be particularly valuable if you require extended care following a hospital stay, as Medicare only fully covers the first 20 days in a skilled nursing facility.

Standardized Plans and Coverage Variations

It’s important to note that while these core benefits are standard across all Medigap plans, the extent of coverage can vary. Some plans might cover 100% of these costs, while others might cover a portion. Medigap policies are standardized, meaning that Plan G from one insurance company offers the same benefits as Plan G from another company. However, premiums can vary significantly.

Choosing the Right Plan

To find the plan that best suits your needs and budget, you should compare different options. Consider factors such as your health status, financial situation, and anticipated healthcare needs. Shopping around and comparing prices from different insurance providers can help you get the best value for your money.

As we explore the additional coverage options in Medigap plans, you’ll gain a fuller understanding of how these policies can provide comprehensive protection for your healthcare needs.

Expanding Your Medigap Coverage: Additional Benefits and Options

Deductible Coverage

Medigap insurance offers more than basic benefits. Many plans provide additional coverage options that enhance your healthcare protection. One valuable benefit is coverage for the Medicare Part A deductible. In 2023, this deductible is $1,600 per benefit period. Many Medigap plans cover this cost entirely, which can save you thousands if you have multiple hospital stays in a year.

Some plans (Plan F and Plan G) also cover the Medicare Part B deductible. However, new Medicare beneficiaries can’t purchase plans that cover the Part B deductible since January 1, 2020. If you became eligible for Medicare before 2020, you may still enroll in or keep these plans. The annual deductible for all Medicare Part B beneficiaries is $226 in 2023, a decrease of $7 from the annual deductible of $233 in 2022.

Excess Charge Protection

Some Medigap plans offer coverage for Medicare Part B excess charges. These are additional fees that doctors who don’t accept Medicare assignment can charge (up to 15% above the Medicare-approved amount). Plans F and G cover these excess charges, which can add up quickly if you see multiple specialists or require frequent medical care.

International Emergency Coverage

For frequent travelers, certain Medigap plans offer foreign travel emergency coverage. This benefit can prove invaluable if you need urgent medical care while abroad. Plans C, D, F, G, M, and N typically cover 80% of approved emergency care costs after a $250 deductible (up to a lifetime limit of $50,000).

Out-of-Pocket Limits

Plans K and L introduce out-of-pocket limits. Once you reach this limit and your Part B deductible, the plan pays 100% of covered services for the rest of the calendar year. In 2023, these limits are $6,940 for Plan K and $3,470 for Plan L. This can provide significant financial protection for those who anticipate high medical expenses.

Selecting the Right Plan

When you select a Medigap plan, consider these additional benefits alongside the core coverage. Your health needs, travel plans, and financial situation should factor into your decision. These additional benefits can provide valuable protection, but they also impact the cost of your Medigap policy. You should weigh the potential out-of-pocket savings against the higher premiums of more comprehensive plans. It’s important to note that Medicare Advantage plans often offer additional services that are not available on standard Medicare plans, which may be an alternative option to consider.

Final Thoughts

Medigap insurance offers a comprehensive suite of benefits that enhance Medicare coverage. These policies address many gaps in Original Medicare, covering hospital costs, outpatient expenses, and providing protection against excess charges. The core benefits form a solid foundation for healthcare protection, while additional options strengthen financial security.

Choosing the right Medigap plan is essential for optimizing healthcare coverage and managing costs effectively. What Medigap insurance covers can vary between plans, so thorough research and comparison are key to finding the best fit. Various standardized plans are available, each offering different levels of coverage to meet individual health needs and financial situations.

At Dave Silver Insurance, we specialize in simplifying the Medicare enrollment process and providing expert guidance on Medigap options. Our team is available seven days a week to answer your questions, explain your options, and help you make informed decisions about your healthcare coverage. We offer personalized recommendations based on your unique health and financial needs to ensure you have the right coverage to protect your well-being.