Choosing between Medicare Advantage and Medigap insurance can be a daunting task for many seniors. These two options offer different approaches to supplementing Original Medicare coverage, each with its own set of benefits and considerations.

At Dave Silver Insurance, we understand the importance of making an informed decision about your healthcare coverage. In this post, we’ll break down the key differences between Medicare Advantage vs Medigap insurance to help you determine which option best suits your needs and preferences.

What Are Medicare Advantage Plans?

A Comprehensive Alternative to Original Medicare

Medicare Advantage plans, also known as Medicare Part C, provide an alternative method to receive Medicare benefits. Private insurance companies, approved by Medicare, offer these plans. They combine coverage for hospital stays (Part A) and medical services (Part B) into one package.

Expanded Coverage Options

Medicare Advantage plans may cover some extra benefits that Original Medicare doesn’t cover, like certain vision, hearing, and dental services. A 2024 Kaiser Family Foundation report states that 99% of these plans offer prescription drug coverage. This eliminates the need for a separate Part D plan. Some even offer gym memberships or transportation to medical appointments.

Cost Structure and Expenses

The potential for lower upfront costs attracts many to Medicare Advantage plans. The Centers for Medicare & Medicaid Services (CMS) projects an average premium of $17 for these plans in 2025. However, it’s important to consider more than just premiums. While these plans cap out-of-pocket expenses ($9,350 for in-network care in 2025), frequent medical services may lead to higher overall costs.

Network Restrictions

Medicare Advantage plans often operate within specific provider networks. This means you must choose doctors and hospitals within the plan’s network to receive the lowest costs. A 2024 Commonwealth Fund study found that 30% of Medicare Advantage enrollees didn’t use any available supplemental benefits, partly due to these network limitations.

Care Coordination

Most Medicare Advantage plans require you to select a primary care physician and obtain referrals for specialist visits. This coordinated approach can benefit those managing complex health conditions. However, it may feel restrictive if you prefer more autonomy in your healthcare decisions.

Medicare Advantage plans can suit those who prefer a structured approach to healthcare and accept network restrictions. However, it’s essential to evaluate your specific healthcare needs and preferences before deciding. Let’s now explore Medigap insurance to understand how it differs from Medicare Advantage plans.

Understanding Medigap Insurance

What is Medigap?

Medicare Supplement Insurance, also known as Medigap, is extra insurance you can buy from a private health insurance company to help pay your share of out-of-pocket costs in Original Medicare.

Standardized Plans for Easy Comparison

The Centers for Medicare & Medicaid Services (CMS) standardizes Medigap plans, offering 10 different options labeled A through N. Each plan type provides the same basic benefits regardless of the insurance company selling it. This standardization allows consumers to compare plans across different insurers easily.

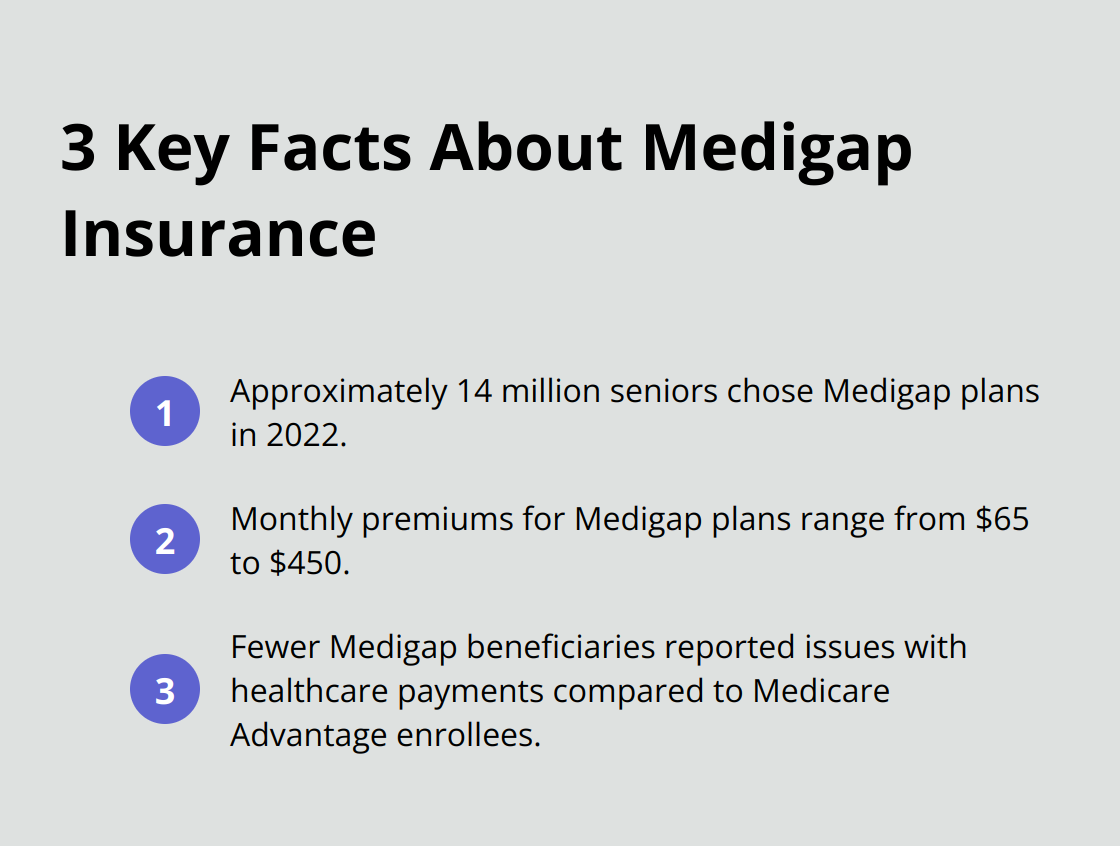

Plan G stands out as the most comprehensive option available to new Medicare beneficiaries. It covers nearly all out-of-pocket costs (except the Part B deductible). In 2022, approximately 14 million seniors chose Medigap plans, which highlights their popularity among those seeking predictable healthcare costs.

Premium Factors and Cost Considerations

Medigap premiums vary based on several factors, including age, location, and the specific plan chosen. Recent data shows monthly premiums can range from $65 to $450. While these premiums are generally higher than those of Medicare Advantage plans, they often result in lower out-of-pocket costs for frequent healthcare users.

It’s important to note that Medigap policies don’t cover prescription drugs. Beneficiaries need to purchase a separate Medicare Part D plan for medication coverage, which adds to the overall cost. However, this separation allows for more tailored coverage based on individual medication needs.

Flexibility in Healthcare Provider Choice

One of the most significant advantages of Medigap insurance is the freedom to choose healthcare providers. Unlike Medicare Advantage plans, Medigap allows beneficiaries to see any doctor or specialist who accepts Medicare without network restrictions. This flexibility proves particularly valuable for those who travel frequently or have established relationships with specific healthcare providers.

A 2024 Kaiser Family Foundation study found that fewer Original Medicare beneficiaries with Medigap coverage reported issues with healthcare payments compared to those with Medicare Advantage plans. This suggests that the predictability and comprehensive coverage of Medigap policies may lead to greater financial peace of mind for many seniors.

The next chapter will compare Medicare Advantage and Medigap plans side by side, helping you understand which option might best suit your needs.

Which Plan Fits Your Healthcare Needs

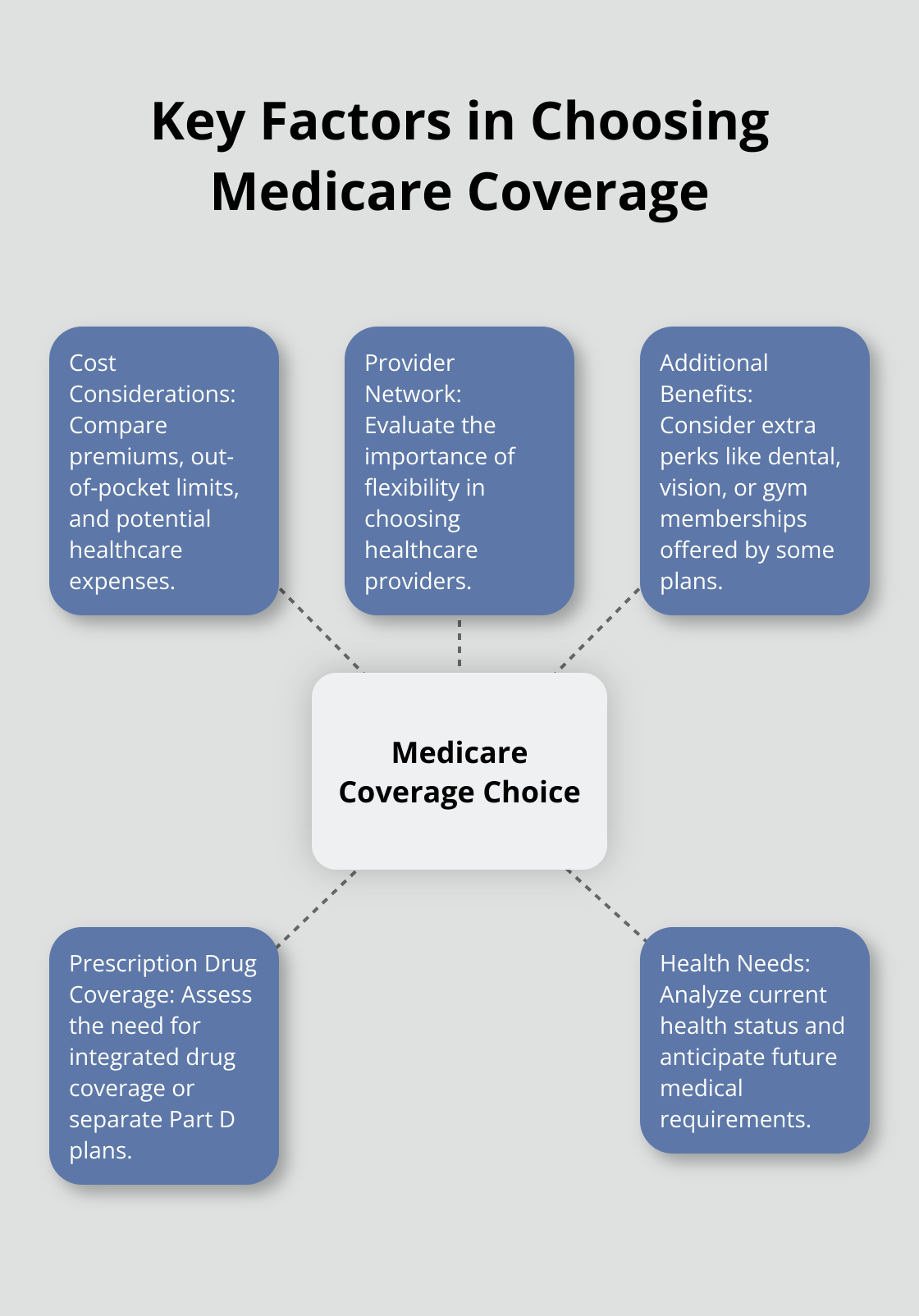

Cost Considerations

Medicare Advantage plans often have lower upfront costs, with the average premium projected to be $17 in 2025. However, these plans can lead to higher out-of-pocket expenses if you require frequent medical care. The Kaiser Family Foundation reports that 23% of Medicare Advantage enrollees spent over 10% of their income on healthcare costs, compared to 17% of Medigap beneficiaries.

Medigap plans typically have higher monthly premiums but can provide more predictable costs over time. For instance, Medigap Plan G covers nearly all out-of-pocket expenses (except the Part B deductible), making it an attractive option for those who anticipate regular medical needs.

Provider Network Flexibility

If maintaining your current doctor relationships is a priority, Medigap might be the better choice. These plans allow you to see any Medicare-accepting provider nationwide without referrals. This flexibility is particularly valuable if you travel frequently or split your time between different locations.

Medicare Advantage plans usually restrict you to a specific network of providers. While this can lead to coordinated care, it may limit your options, especially if you require specialized treatment not available within the network.

Additional Benefits

Medicare Advantage plans often include extra perks not covered by Original Medicare, such as dental, vision, and hearing services. Some even offer gym memberships or transportation to medical appointments. These additional benefits can be attractive if you’re looking for comprehensive coverage under one plan.

Medigap policies focus solely on covering gaps in Original Medicare and don’t typically offer these extra services. If you want these additional benefits with Medigap, you’ll need to purchase separate plans, which can increase your overall costs.

Prescription Drug Coverage

Most Medicare Advantage plans include prescription drug coverage, simplifying your healthcare management. With Medigap, you’ll need to enroll in a separate Part D plan for medication coverage. The Centers for Medicare & Medicaid Services projects that starting in 2025, out-of-pocket costs for Part D drugs will be capped at $2,000, eliminating the coverage gap (often referred to as the “donut hole”).

Evaluating Your Health Needs

To make the best decision, assess your current health status and anticipate future needs. If you have chronic conditions requiring frequent specialist visits, Medigap’s flexibility might be more beneficial. Conversely, if you’re generally healthy and prefer having extra benefits like dental coverage, a Medicare Advantage plan could be more suitable.

Consider your budget carefully. While Medicare Advantage plans might seem more affordable initially, calculate potential out-of-pocket costs based on your expected healthcare utilization. The maximum out-of-pocket limit for Medicare Advantage plans in 2025 will be $9,350 for in-network care, which could be a significant expense if you require extensive medical services.

Try to review your healthcare usage from the past few years to project future needs. This analysis can help determine whether the potentially higher premiums of Medigap or the network restrictions of Medicare Advantage align better with your situation.

Your Medicare choices aren’t set in stone. You have opportunities to switch plans during annual enrollment periods. However, changing from Medicare Advantage to Medigap outside of specific timeframes may subject you to medical underwriting, potentially affecting your eligibility or premiums.

Final Thoughts

Medicare Advantage vs Medigap insurance presents a significant choice that impacts your healthcare coverage and financial well-being. Both options offer distinct benefits, with the right choice depending on your individual circumstances, health needs, and preferences. At Dave Silver Insurance, we understand the complexities of Medicare and the importance of making an informed decision.

Our team offers personalized guidance to help you navigate your options (with over 17 years of expertise in Medicare enrollment). We can help you compare plans, understand the nuances of Medicare Advantage and Medigap insurance, and ensure you make the best choice for your situation. Our goal is to simplify the process and give you confidence in your healthcare decisions.

To get started, schedule a consultation with Dave Silver Insurance. We’ll review your specific circumstances, answer your questions, and provide clear, unbiased recommendations. With our support, you can make an informed choice between Medicare Advantage and Medigap insurance, ensuring you have the right coverage for your healthcare journey.