At Dave Silver Insurance, we understand the importance of timely Medicare coverage decisions.

The Special Enrollment Period for Medicare Part D offers a crucial opportunity for beneficiaries to adjust their prescription drug coverage outside of regular enrollment windows.

This blog post will guide you through the ins and outs of Special Enrollment Periods, helping you navigate qualifying events and enrollment procedures with confidence.

Special Enrollment Periods for Medicare Part D: Your Gateway to Flexible Coverage

Defining Special Enrollment Periods

Special Enrollment Periods (SEPs) for Medicare Part D provide specific timeframes outside standard enrollment windows. During these periods, eligible individuals can modify their prescription drug coverage. These opportunities arise from life events or circumstances that impact Medicare coverage needs.

Qualifying Life Events That Trigger SEPs

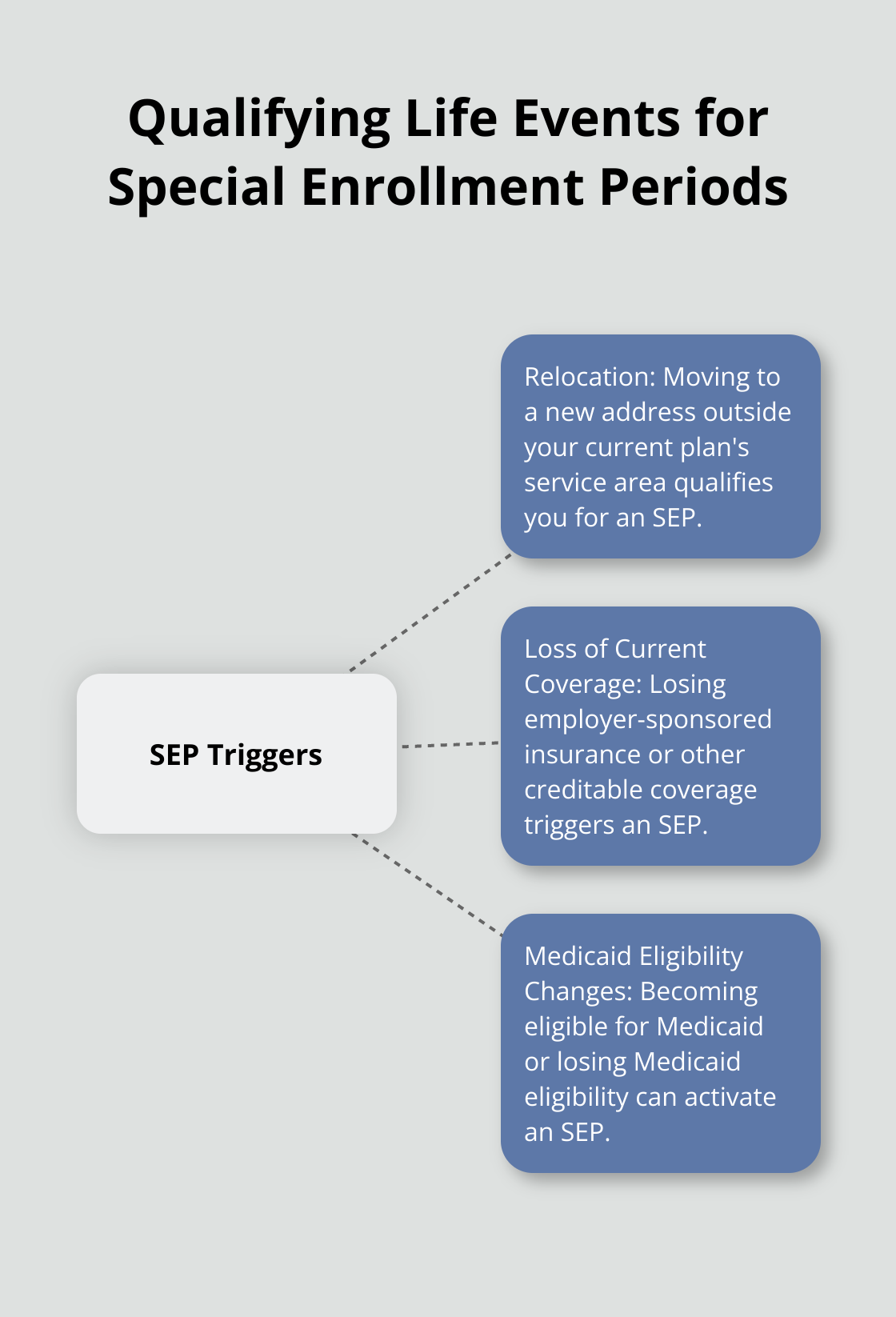

Several situations can activate a Special Enrollment Period:

- Relocation: If you change where you live, you may be eligible for an SEP.

- Loss of Current Coverage: Losing employer-sponsored insurance (or other creditable coverage) qualifies you for an SEP.

- Medicaid Eligibility Changes: Becoming eligible for Medicaid allows you to enroll in a Part D plan at any time. If you lose Medicaid eligibility, you may be eligible for an SEP.

The Importance of SEPs

SEPs ensure continuous and appropriate coverage for Medicare beneficiaries. They offer flexibility to adapt to changing life circumstances without being trapped in unsuitable plans or experiencing coverage gaps.

Effective SEP Navigation

Understanding and utilizing SEPs effectively proves essential for optimal Medicare coverage. Timely use of SEPs can save beneficiaries from significant out-of-pocket expenses.

Time Limits and Documentation

Documentation often proves necessary to establish eligibility for an SEP. This might include proof of address change, loss of coverage letters, or Medicaid eligibility notifications. Keeping these documents readily available streamlines the enrollment process during an SEP.

As we move forward, let’s explore common situations that qualify for Special Enrollment Periods in more detail, helping you identify when you might be eligible for these valuable opportunities to adjust your Medicare Part D coverage.

When Can You Change Your Medicare Part D Plan?

Relocating to a New Service Area

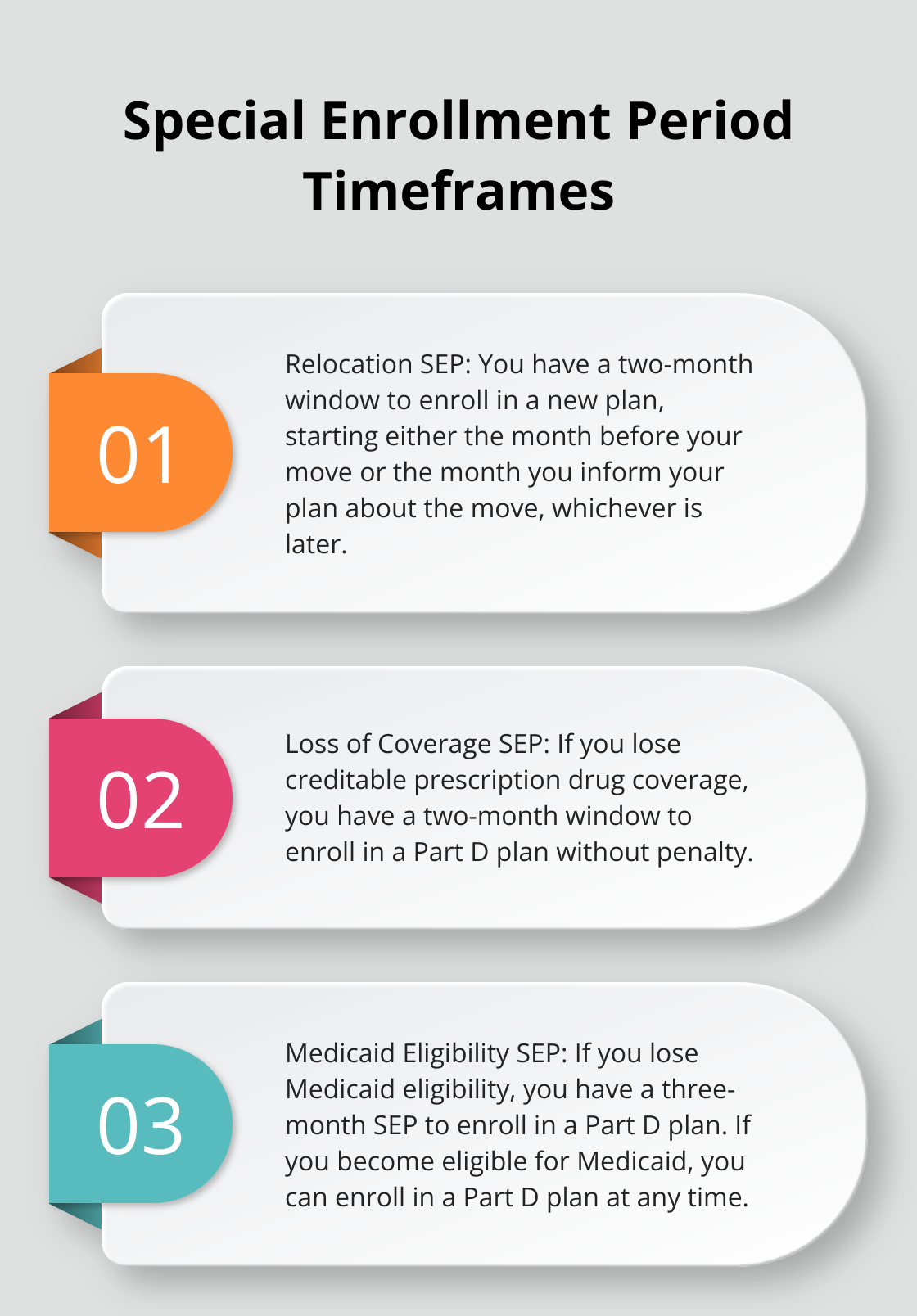

Moving to a new address can significantly affect your Medicare Part D coverage. If you relocate outside your current plan’s service area, you have a two-month window to enroll in a new plan that serves your new location. This Special Enrollment Period (SEP) starts either the month before your move or the month you inform your plan about the move (whichever is later).

Quick action is essential when you move. If you delay your plan change, you could experience a gap in your prescription drug coverage, potentially leading to higher out-of-pocket costs or even late enrollment penalties.

Losing Your Current Coverage

Life changes such as retirement or loss of employer-sponsored insurance can trigger an SEP for Medicare Part D. If you lose creditable prescription drug coverage (coverage that’s at least as good as Medicare’s standard benefit), you have a two-month window to enroll in a Part D plan without penalty.

This SEP is particularly important because going without creditable coverage for more than 63 days can result in a late enrollment penalty that permanently increases your Part D premium. To avoid this situation, try to enroll in a Part D plan as soon as you lose your previous coverage.

Changes in Medicaid Eligibility

Gaining or losing Medicaid eligibility can significantly affect your Medicare coverage options. If you become eligible for Medicaid, you can enroll in a Part D plan at any time. Conversely, if you lose Medicaid eligibility, you have a three-month SEP to enroll in a Part D plan.

These transitions can be complex, and it’s important to understand how your drug coverage may change. For instance, if you’re dual-eligible (qualified for both Medicare and Medicaid), you might be automatically enrolled in a prescription drug plan, but you still have the right to choose a different plan if desired.

Qualifying for Extra Help

The Extra Help program (also known as the Low-Income Subsidy or LIS) provides financial assistance for Medicare prescription drug costs. As of January 1st, the Special Enrollment Periods for dual eligibles and people with Extra Help has shifted to a monthly schedule.

This flexibility is invaluable for beneficiaries with limited incomes, as it allows them to adjust their coverage as their financial situation or medication needs change throughout the year.

These are just a few of the many situations that can trigger a Special Enrollment Period for Medicare Part D. Each circumstance has specific rules and timeframes, and navigating these can be challenging. Professional guidance can help ensure you make the most of these enrollment opportunities and maintain the coverage you need.

In the next section, we’ll explore the steps you need to take to enroll during a Special Enrollment Period, including the documentation you might need and how to avoid late enrollment penalties.

Navigating Your Special Enrollment Period

Understanding Your Timeframe

Most Special Enrollment Periods (SEPs) last for two months from the qualifying event. If you move to a new service area, your SEP starts either the month before your move or the month you notify your plan (whichever is later). Act quickly to avoid coverage gaps or late enrollment penalties.

Gathering Necessary Documentation

Collect all relevant documentation before you start the enrollment process. This typically includes proof of your qualifying event, such as:

- A change of address form for relocations

- A letter from your employer for loss of coverage

- Medicaid eligibility notifications

Having these documents ready will speed up the enrollment process and prevent delays.

Selecting Your New Plan

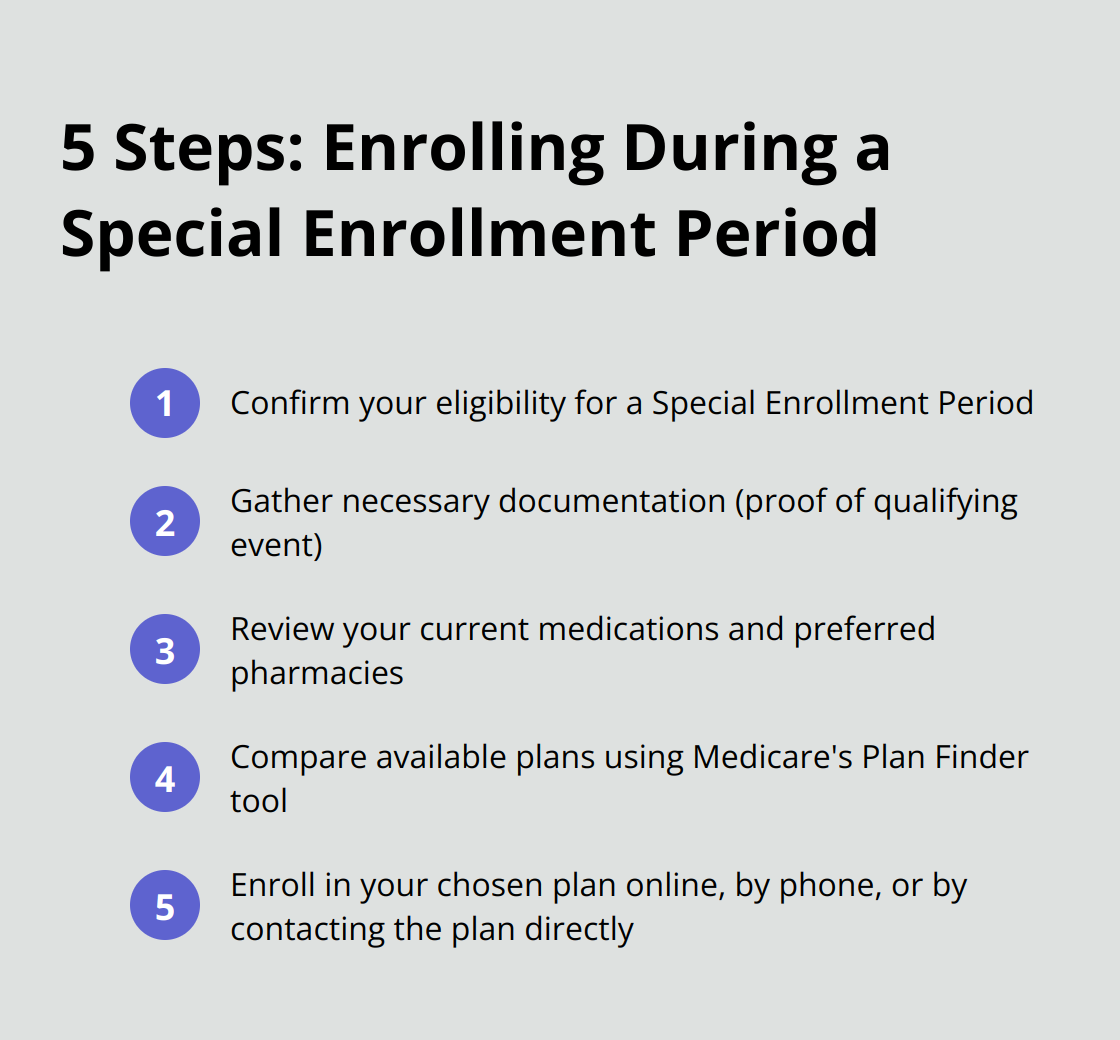

Once you confirm your eligibility for an SEP, choose your new Medicare Part D plan. Follow these steps:

- Review your current medications and preferred pharmacies.

- Compare available plans in your area using Medicare’s Plan Finder tool.

- Evaluate each plan’s formulary to ensure it covers your medications.

- Check if your preferred pharmacy is in the plan’s network.

- Assess the total costs (premiums, deductibles, and copayments).

Enrolling in Your Chosen Plan

After you select a plan, you can enroll through various methods:

- Online through the Medicare website

- By calling 1-800-MEDICARE

- By contacting the plan directly

Professional guidance can help you understand all your options and make an informed decision.

Avoiding Late Enrollment Penalties

Late enrollment penalties can significantly increase your Medicare Part D costs over time. Enroll in a Part D plan as soon as you’re eligible, whether during your Initial Enrollment Period or an SEP.

If you’ve had a gap in creditable coverage for more than 63 days, you may face a penalty. However, if your SEP results from losing creditable coverage, prompt enrollment can help you avoid this penalty.

Final Thoughts

Special Enrollment Periods for Medicare Part D provide essential flexibility for beneficiaries to adjust their prescription drug coverage. These periods allow individuals to adapt to life changes without compromising their healthcare needs. Prompt action during these periods prevents coverage gaps and potential late enrollment penalties that could impact healthcare costs for years.

Medicare’s complexities often require professional guidance to navigate effectively. Dave Silver Insurance specializes in simplifying the Medicare enrollment process, including Part D prescription drug coverage. Our team offers personalized advice seven days a week to help you make informed decisions about your healthcare coverage.

Your health needs are unique, and your Medicare coverage should reflect that. Understanding Special Enrollment Periods for Medicare Part D helps you secure the most appropriate and cost-effective coverage for your situation. Take advantage of these periods when they arise to optimize your prescription drug coverage and protect your health.