Navigating the world of Medicare Supplement insurance can be complex, especially when it comes to timing your enrollment.

At Dave Silver Insurance, we often hear the question: “When does the open enrollment period for Medicare Supplements begin?” The answer is crucial for securing the best coverage without penalties or restrictions.

Let’s explore the key dates and factors you need to know to make informed decisions about your Medicare Supplement insurance.

When Does Medicare Supplement Open Enrollment Begin?

The Six-Month Window

Medicare Supplement insurance (Medigap) fills the gaps in Original Medicare coverage. The Medicare Supplement Open Enrollment Period starts on the first day of the month when you turn 65 and enroll in Medicare Part B. This period lasts six months, allowing you to select a plan that meets your needs. During this time, insurance companies must sell you a Medigap policy regardless of your health status and cannot charge higher premiums based on pre-existing conditions.

The Importance of Timing

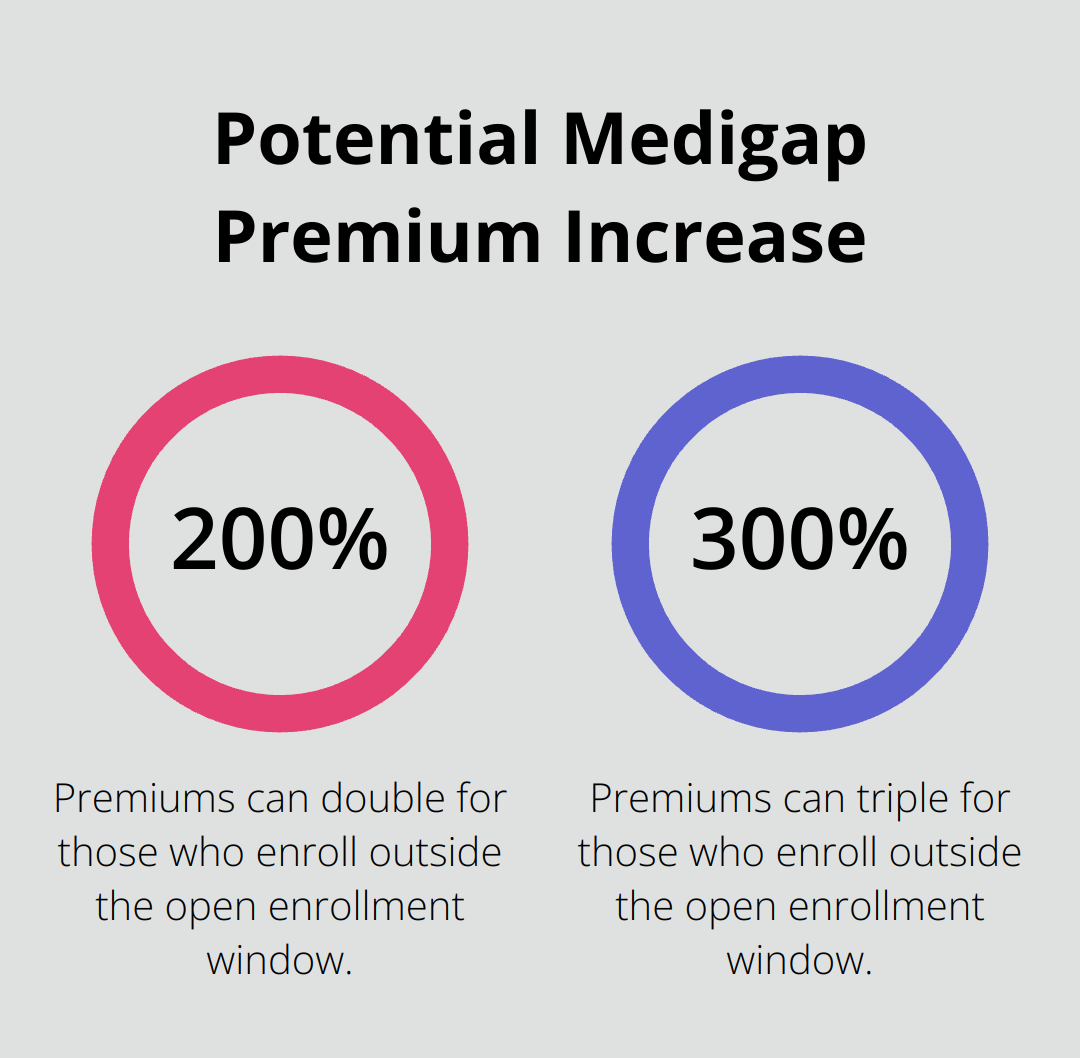

Enrolling during this initial period is essential. If you miss it, you might face higher premiums or even coverage denial. A 2023 Kaiser Family Foundation study revealed that Medigap policy premiums can be significantly higher (sometimes double or triple the standard rate) for those who enroll outside their open enrollment window.

Guaranteed Issue Rights

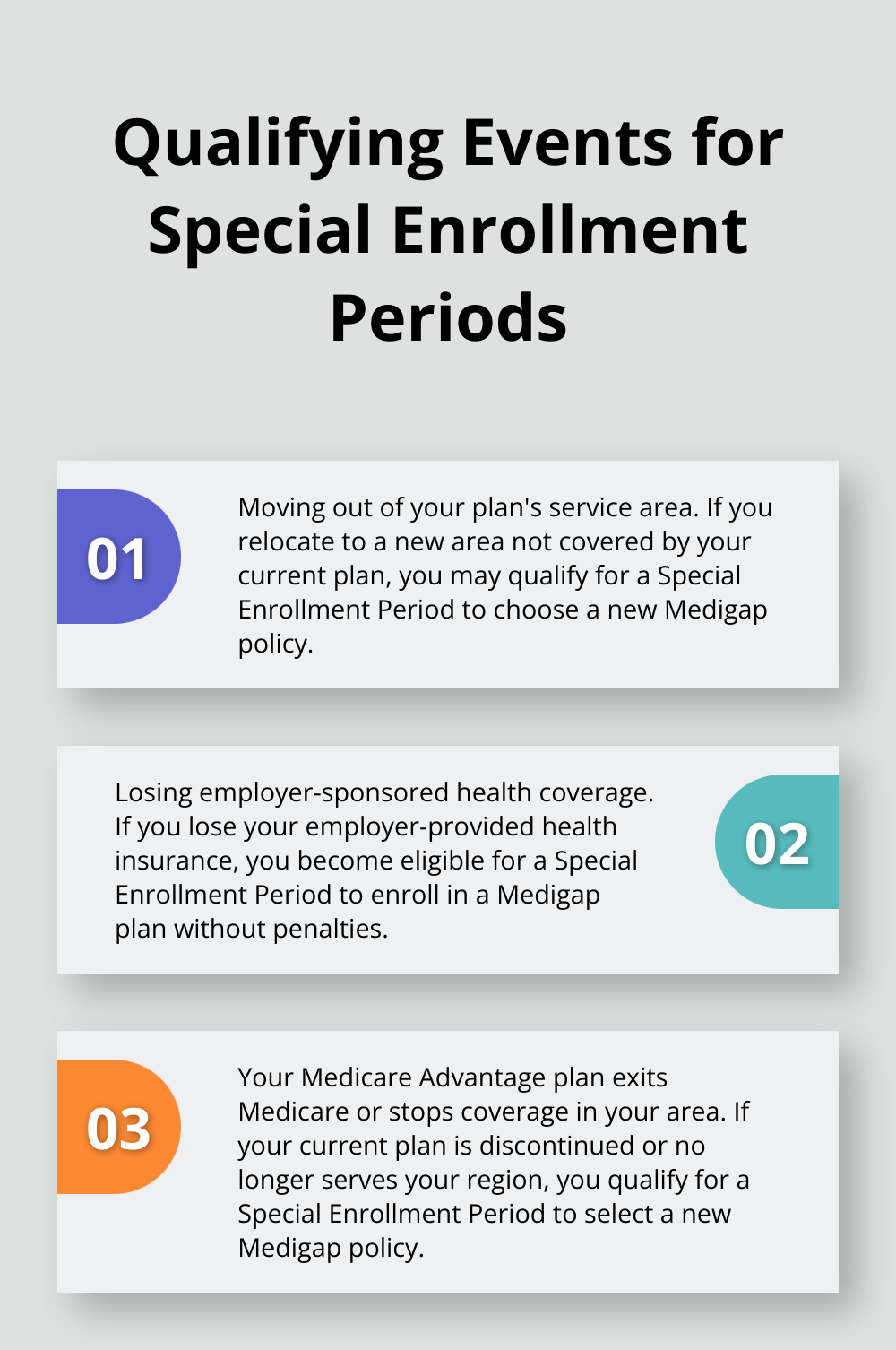

In certain situations, you might have guaranteed issue rights outside of your open enrollment period. These rights allow you to purchase a Medigap policy without medical underwriting. For example, you may qualify for a guaranteed issue right if you lose your employer-sponsored health coverage or move out of your Medicare Advantage plan’s service area.

State-Specific Regulations

Some states have unique rules for Medigap enrollment. New York and Connecticut, for instance, offer continuous open enrollment, allowing residents to purchase Medigap policies year-round without medical underwriting. It’s vital to check your state’s specific regulations to understand all your options.

Planning Ahead

To make the most of your Medicare Supplement Open Enrollment Period, start your research well before your 65th birthday. This proactive approach can save you thousands of dollars in healthcare costs over the years. Consider consulting with a Medicare specialist to navigate the complexities of Medigap policies and ensure you choose the right coverage for your needs.

As we move forward, let’s explore the various factors you should consider when selecting a Medicare Supplement plan during your open enrollment period.

Key Dates for Medicare Supplement Open Enrollment

Standard Medigap Open Enrollment Period

The Initial Enrollment Period for Medicare lasts for 7 months, starting 3 months before you turn 65, and ending 3 months after the month you turn 65. During this time, you can enroll in Medicare Part B and begin your Medigap Open Enrollment Period. This six-month window allows you to compare plans and make an informed decision. During this time, insurance companies must sell you a Medigap policy regardless of your health status and cannot charge higher premiums for pre-existing conditions.

For instance, if your 65th birthday falls on July 15 and you enroll in Medicare Part B that month, your Medigap Open Enrollment Period will run from July 1 to December 31. Taking advantage of this period is essential, as missing it could result in higher premiums or even coverage denial later.

Special Enrollment Periods

Life doesn’t always align with standard enrollment periods. Special Enrollment Periods (SEPs) accommodate specific life events that occur outside the standard window. Qualifying events include:

These events typically trigger a 63-day window for you to enroll in a Medigap policy without medical underwriting. This means you can still obtain coverage without facing higher premiums or potential denial due to health conditions.

State-Specific Rules

While federal guidelines set the standard for Medigap enrollment, some states have implemented their own rules to provide additional opportunities for residents. New York and Connecticut (known for their consumer-friendly policies) offer continuous open enrollment, allowing residents to purchase Medigap policies at any time without medical underwriting.

Other states have specific provisions for individuals under 65 who qualify for Medicare due to disability. Massachusetts, Maine, and Vermont require insurance companies to offer at least one type of Medigap policy to Medicare beneficiaries under 65 during certain times of the year.

It’s important to check with your state’s insurance department or a licensed insurance agent to understand the specific rules that apply in your area. These state-specific regulations can significantly expand your options and potentially save you money on premiums.

As we move forward, let’s examine the various factors you should consider when selecting a Medicare Supplement plan during your open enrollment period.

Choosing the Right Medigap Plan for You

Assess Your Coverage Needs

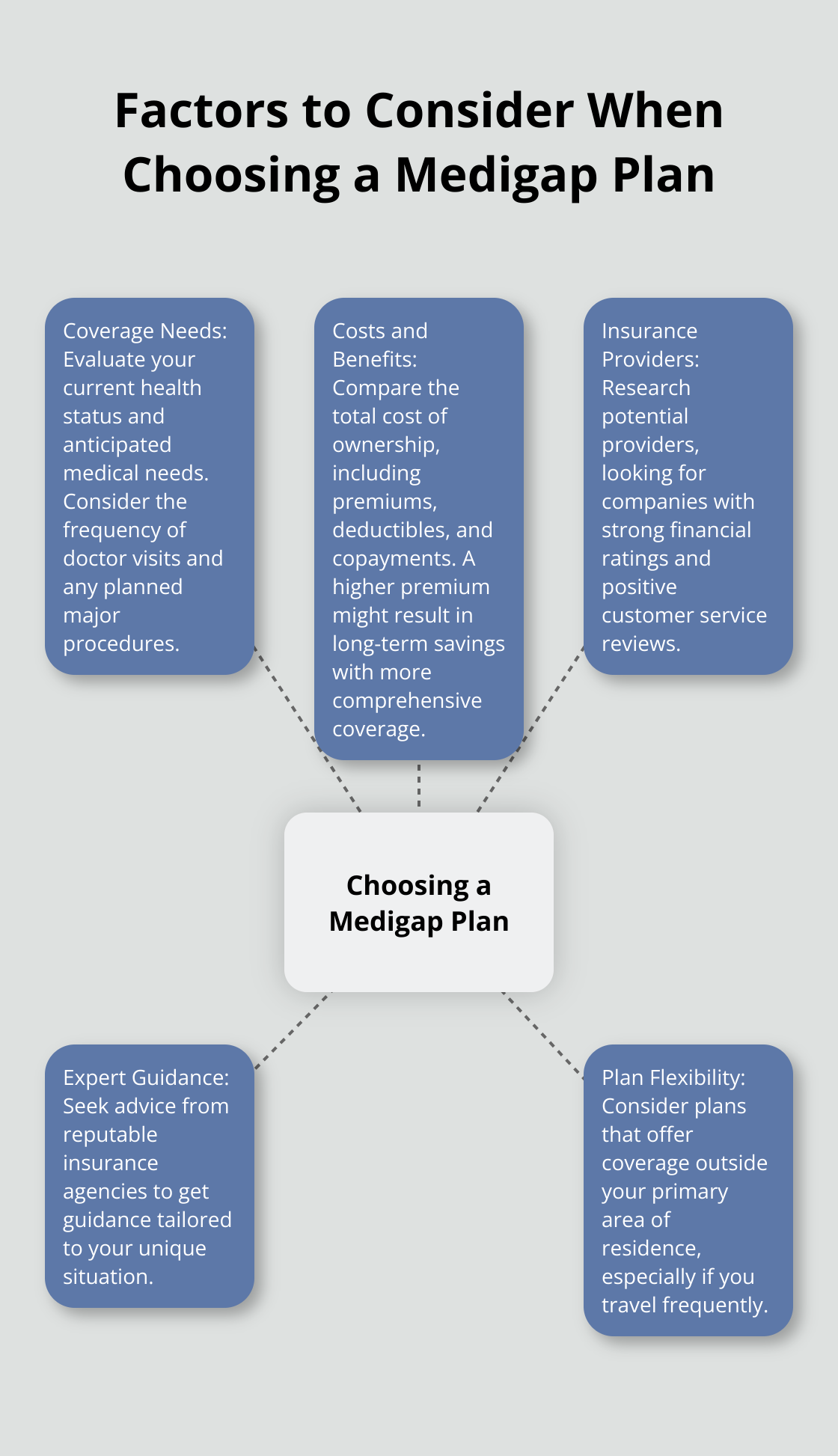

Start with an evaluation of your current health status and anticipated medical needs. Consider these questions: Do you have chronic conditions that require frequent doctor visits? Are you planning any major procedures in the near future? Your answers will guide your Medigap plan choice.

For those in good health with infrequent doctor visits, a high-deductible Plan G might offer cost-effective coverage. Individuals requiring frequent medical care should consider more comprehensive options like Plan F (if eligible) or Plan G for better financial protection.

Compare Costs and Benefits

Avoid the temptation to select the plan with the lowest premium. Instead, examine the total cost of ownership, including premiums, deductibles, and copayments. A plan with a higher premium might result in long-term savings if it provides more comprehensive coverage.

Use the Medicare.gov website’s comparison tool to evaluate Medigap plans side-by-side. This resource allows you to explore your Medicare coverage options, get a summary of your current coverage, and use your saved drugs & pharmacies to compare plan costs.

Research Insurance Providers

Not all insurance companies offer equal service. Conduct thorough research on potential providers before making a decision. Look for companies with strong financial ratings from independent agencies (like A.M. Best or Standard & Poor’s). These ratings indicate a company’s ability to pay future claims.

Customer service quality is another important factor. Read reviews from current policyholders to understand how responsive and helpful the company is when issues arise. The National Association of Insurance Commissioners (NAIC) provides a complaint index that compares companies based on customer satisfaction.

Consider Expert Guidance

The plan you choose during your initial enrollment period can significantly impact your future healthcare costs and coverage. Take time to carefully consider your options. Don’t hesitate to seek expert advice from a reputable insurance agency (such as Dave Silver Insurance). Their experience in the Medicare field allows them to provide guidance tailored to your unique situation.

Review Plan Flexibility

Some Medigap plans offer more flexibility than others. For example, certain plans allow you to see any doctor who accepts Medicare, while others might have network restrictions. If you travel frequently or split your time between different locations, consider a plan that offers coverage outside your primary area of residence.

Final Thoughts

The open enrollment period for Medicare Supplements begins at age 65 and lasts for six months after you enroll in Medicare Part B. This window offers a unique opportunity to choose a Medigap plan without facing medical underwriting or higher premiums due to pre-existing conditions. Enrolling during this initial period can lead to significant long-term savings and better healthcare coverage.

Choosing the right Medicare Supplement plan involves careful consideration of your health needs, budget, and desired coverage level. With numerous options available, you might find it challenging to navigate this complex landscape. Expert guidance can prove invaluable in making informed decisions about your Medicare coverage.

Dave Silver Insurance offers personalized assistance to help you understand your Medicare options. Their team provides advice based on individual health and financial needs. Don’t leave your Medicare decisions to chance; seek professional guidance to secure the coverage you need for a healthier future.