Navigating the world of Medicare can be complex, especially when it comes to understanding supplemental coverage options. At Dave Silver Insurance, we often encounter clients who are unsure about the role of Medigap insurance in their healthcare planning.

The purpose of Medigap insurance is to fill the gaps in Original Medicare coverage, providing additional financial protection and peace of mind. In this post, we’ll break down the key aspects of Medigap plans and help you determine if this type of coverage is right for your needs.

What Is Medigap Insurance?

The Essence of Medigap Coverage

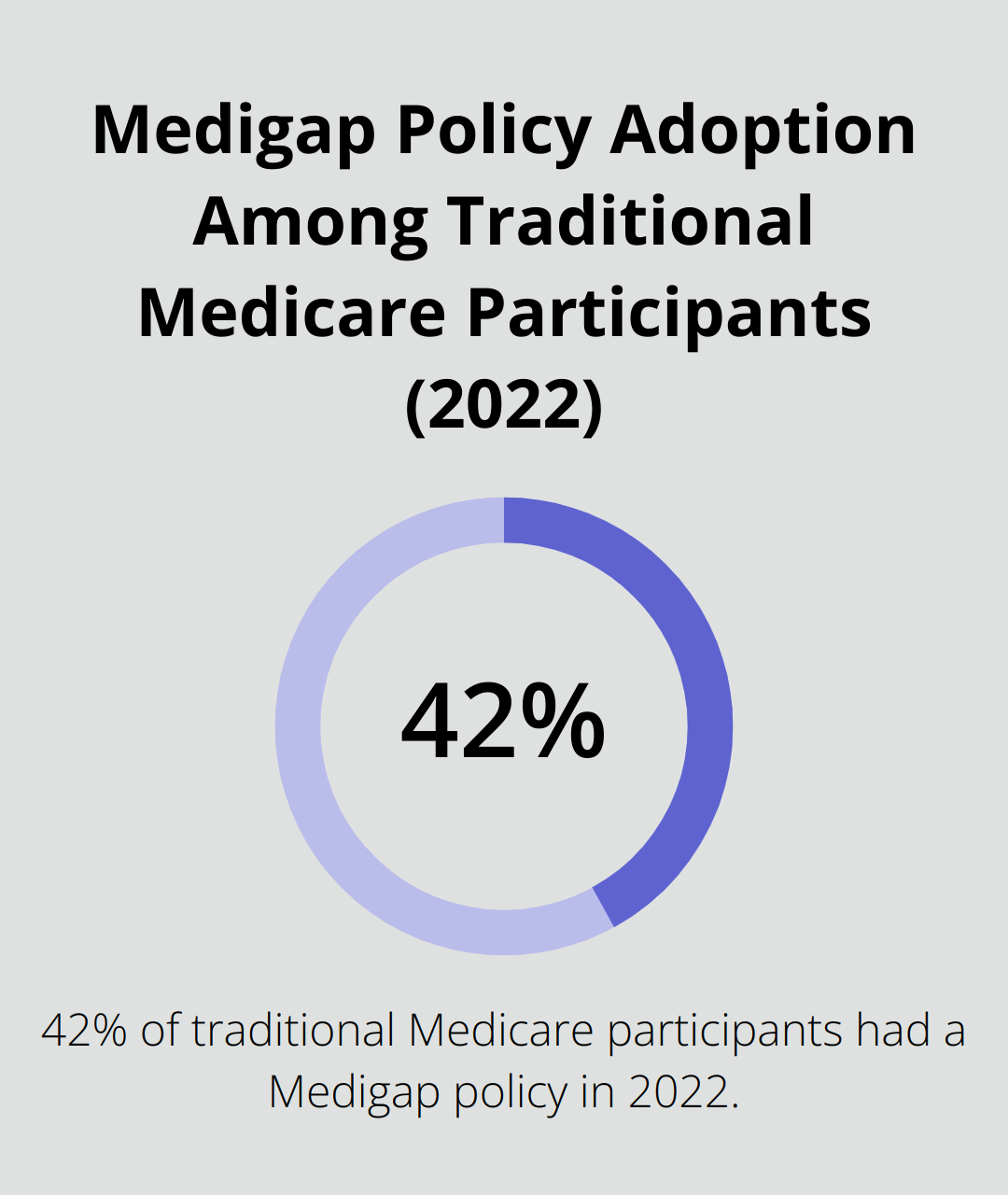

Medigap insurance is extra insurance you can buy from a private health insurance company to help pay your share of out-of-pocket costs in Original Medicare. Private insurance companies sell these policies to provide additional financial protection against out-of-pocket expenses. In 2022, about 12.5 million Medicare beneficiaries (42% of traditional Medicare participants) had a Medigap policy, according to the Centers for Medicare & Medicaid Services (CMS).

Medigap vs. Original Medicare

Original Medicare offers essential health coverage but leaves beneficiaries vulnerable to high out-of-pocket costs. Medigap addresses this issue. For example, if you need hospitalization, Original Medicare covers part of your stay, but you must pay the Part A deductible ($1,600 in 2023). A Medigap policy can cover this deductible, which reduces your financial burden significantly.

Available Medigap Plans

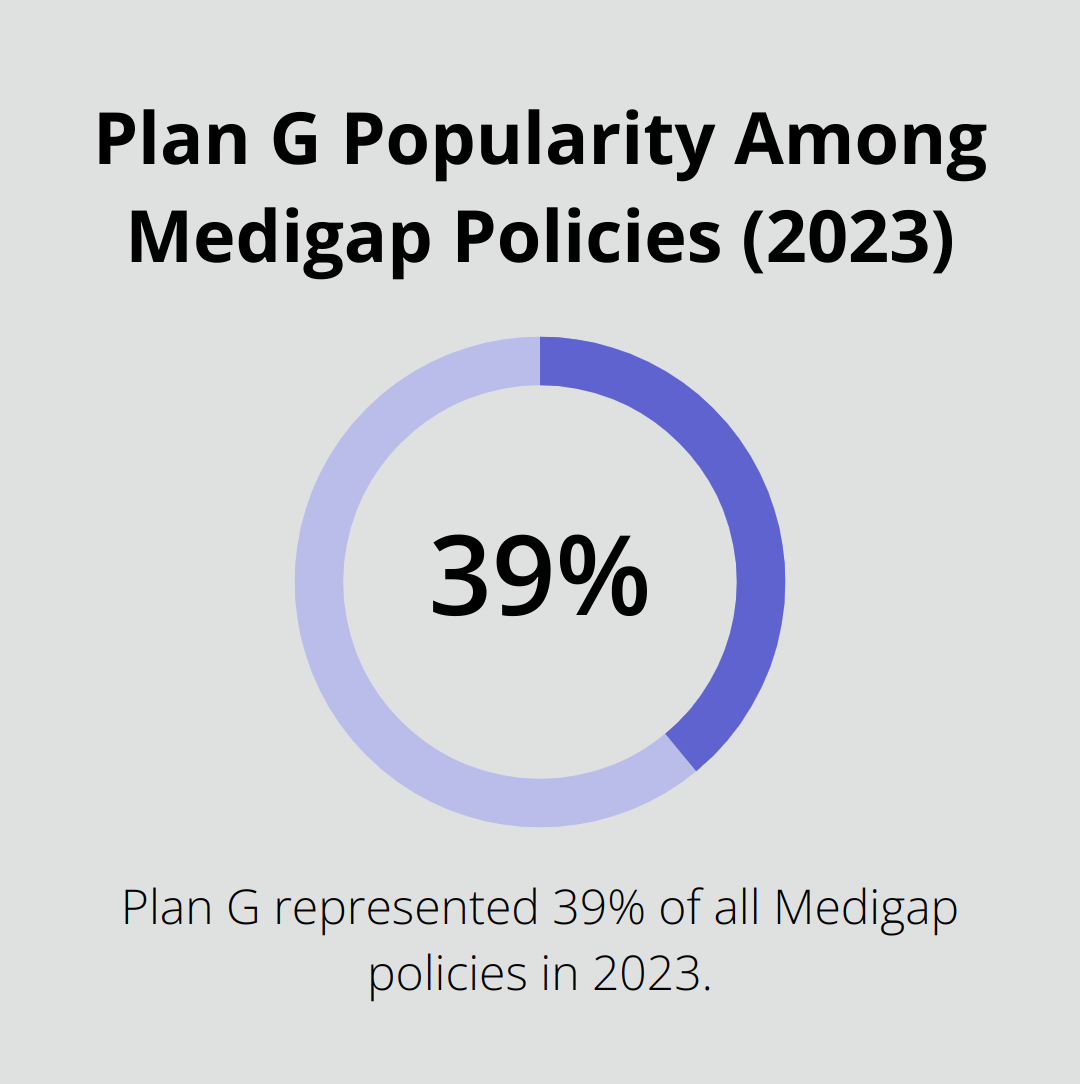

As of 2023, most states offer eight standardized Medigap plans (A, B, D, G, K, L, M, and N). Each plan provides a different level of coverage, allowing beneficiaries to select based on their specific needs and budget. Recent data shows Plan G has become the most popular option, representing 39% of all Medigap policies in 2023.

Cost Considerations

In 2023, the average monthly premium for Medigap policies was $217. However, this amount varies based on factors such as location, age, and the specific plan chosen. Plan G premiums, for instance, ranged from approximately $140 to $236 depending on the state.

It’s important to compare the cost of premiums against potential out-of-pocket expenses without Medigap coverage. This analysis helps determine if Medigap is a cost-effective choice for your situation.

Enrollment and Eligibility

To qualify for a Medigap policy, you must enroll in both Medicare Part A and Part B. The ideal time to purchase a Medigap policy is during the Medigap Open Enrollment Period, which lasts six months starting at age 65. Missing this initial enrollment window can result in higher costs or potential denial of coverage.

Understanding the intricacies of Medigap insurance is essential for making informed decisions about your healthcare coverage. In the next section, we’ll explore the key benefits of Medigap insurance and how it can enhance your overall healthcare protection.

Why Choose Medigap Insurance?

Financial Protection Against High Costs

Medigap insurance offers substantial benefits for Medicare beneficiaries by addressing key gaps in Original Medicare coverage. It provides additional financial protection for seniors, covering out-of-pocket costs that Original Medicare doesn’t pay for.

Extended Coverage Beyond Original Medicare

Medigap policies provide coverage for services not included in Original Medicare. Some Medigap plans offer coverage for medical care when you travel outside the United States. This can be particularly valuable for retirees who plan to travel extensively.

Additionally, certain Medigap plans cover the Medicare Part B excess charges. These are additional fees that some healthcare providers may charge above the Medicare-approved amount. Coverage of these excess charges protects you from unexpected bills and expands your provider options.

Freedom to Choose Your Healthcare Providers

One of the most appreciated features of Medigap insurance is the flexibility it offers in choosing healthcare providers. Unlike Medicare Advantage plans, Medigap allows beneficiaries to see any doctor or specialist who accepts Medicare without network restrictions.

This flexibility can be crucial, especially if you have specific healthcare needs or prefer to see certain specialists.

Peace of Mind and Predictable Costs

Medigap insurance provides peace of mind by making healthcare costs more predictable. With a Medigap policy, you know in advance what your out-of-pocket expenses will be, which allows for better financial planning. This predictability is particularly important for those on fixed incomes or who want to avoid unexpected medical bills.

The benefits of Medigap insurance are clear, but choosing the right Medigap plan is essential for optimizing healthcare coverage and managing costs effectively. In the next section, we’ll explore how to select the Medigap plan that best suits your healthcare requirements and budget.

How to Select the Best Medigap Plan for You

Assess Your Health Needs and Budget

The selection of the right Medigap plan requires a thorough evaluation of your current health status and anticipated medical needs. You should consider factors such as chronic conditions, frequency of doctor visits, and potential surgeries or treatments. A review of your financial situation is equally important. A 2023 study by the Kaiser Family Foundation revealed that the average monthly premium for Medigap policies was $217, but this amount can vary widely based on the plan and location.

Understand Plan Differences

Medigap plans offer standardized benefits, but they provide different levels of coverage. Plan G has gained popularity, covering 39% of all Medigap policies in 2023. It offers comprehensive coverage, including the Part B excess charges, which can prove valuable if you often see specialists.

Plan N presents another option to consider. It offers lower premiums but requires copayments for some office and emergency room visits. This plan might suit you if you’re in good health and don’t mind paying small copays for occasional visits.

Consider Long-Term Value

The plan with the lowest premium might not always be the most cost-effective option in the long run. A plan with a slightly higher premium but more comprehensive coverage could save you money if you require frequent medical care.

If you travel frequently, you should consider a plan that offers foreign travel emergency coverage. Plans C, D, F, G, M, and N provide this benefit, covering 80% of emergency care costs abroad after a $250 deductible.

Seek Expert Guidance

The complexity of Medigap options makes expert advice invaluable. Insurance professionals can offer personalized consultations to help you understand your options and make an informed decision. These experts stay up-to-date with the latest Medicare regulations and can provide insights tailored to your specific situation.

Timing Your Enrollment

The optimal time to enroll in a Medigap plan is during your Medigap Open Enrollment Period. Under federal law, you get a 6 month “Medigap Open Enrollment” period. It starts the first month you have Medicare Part B and you’re 65 or older. This period grants you guaranteed issue rights, which means insurance companies can’t deny you coverage or charge higher premiums based on your health status.

The selection of the right Medigap plan demands careful consideration of your health needs, budget, and long-term goals. A thorough understanding of your options (coupled with expert guidance) can lead you to select a plan that provides the coverage you need at a price you can afford.

Final Thoughts

The purpose of Medigap insurance is to fill the gaps left by Original Medicare. It covers out-of-pocket expenses such as deductibles, copayments, and coinsurance, which allows seniors to manage their healthcare costs more effectively. Medigap insurance provides enhanced financial protection and peace of mind, enabling beneficiaries to access a wider range of medical services without the worry of unexpected bills.

Selecting the right Medigap plan requires careful consideration of individual health needs, budget constraints, and long-term healthcare goals. Various standardized plans offer different levels of coverage, which can make the decision-making process complex. This complexity highlights the importance of seeking personalized guidance from Medicare experts who can provide tailored recommendations based on your unique circumstances.

At Dave Silver Insurance, we offer expert advice on all aspects of Medicare, including Medigap insurance options. Our team assesses your individual needs and provides up-to-date knowledge of Medicare regulations (available seven days a week). We strive to help you navigate the Medicare landscape and select a plan that aligns with your health requirements and financial situation.