Navigating the world of health insurance can be confusing, especially when it comes to understanding the difference between Medigap and supplemental insurance. At Dave Silver Insurance, we often encounter clients who are unsure about which option best suits their needs.

In this blog post, we’ll break down the key distinctions between these two types of coverage, helping you make an informed decision about your healthcare protection.

What Is Medigap Insurance?

The Basics of Medigap

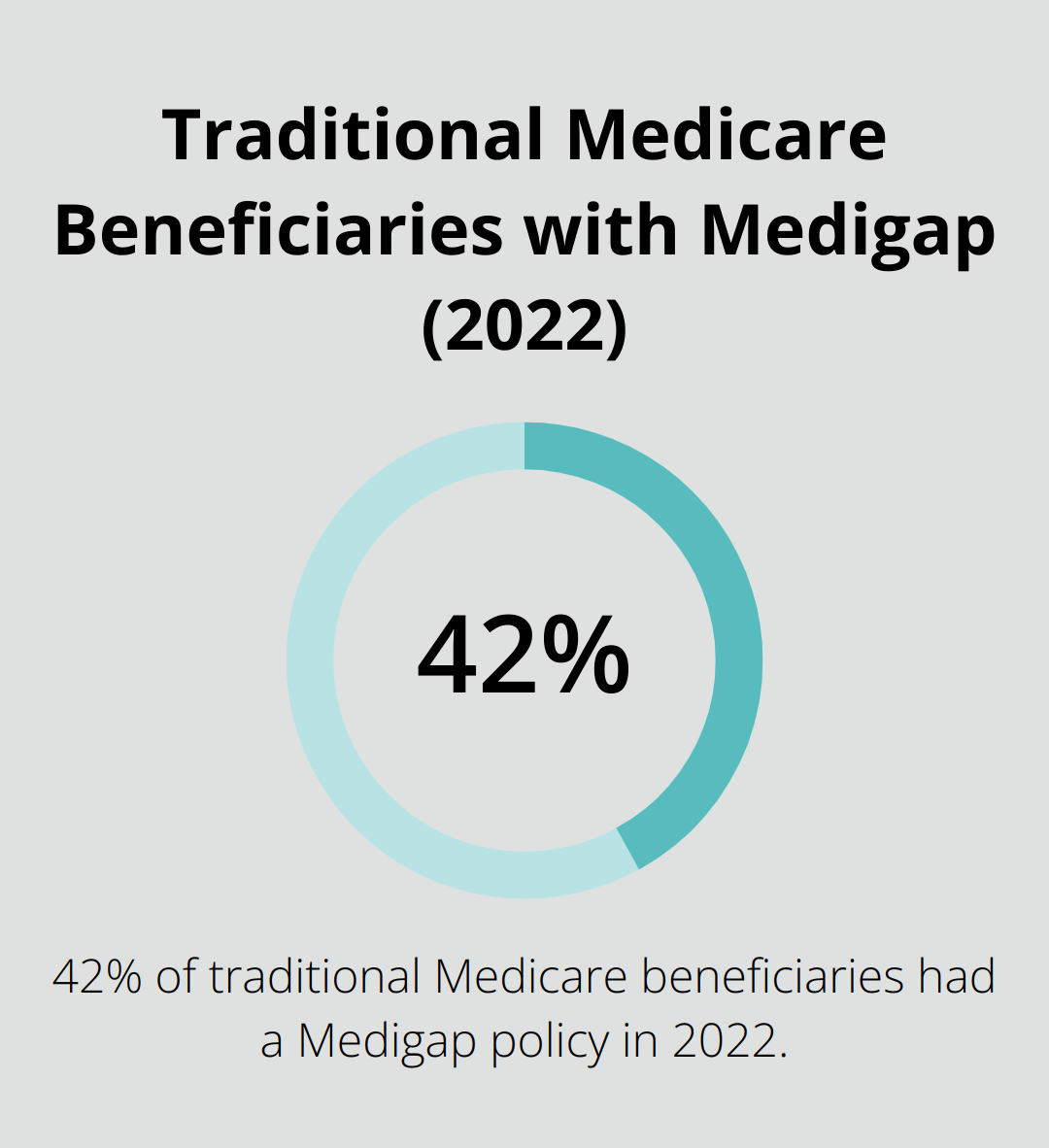

Medigap insurance helps cover your share of costs for services that are covered by Original Medicare (Part A and Part B). This type of insurance fills the “gaps” in Original Medicare coverage. Medigap policies help pay for expenses like copayments, coinsurance, and deductibles that Original Medicare doesn’t cover. The Centers for Medicare & Medicaid Services (CMS) reported that in 2022, 12.5 million (or 42%) of individuals in traditional Medicare had a Medigap policy.

Standardized Plans and Coverage Options

Medigap plans come in standardized formats, identified by letters (A through N). Each plan offers a different level of coverage, but the benefits remain consistent across insurance companies for each letter plan. For example, Plan G emerged as the most popular plan type in 2023, covering 39% of all Medigap policyholders.

It’s worth noting that Plans C and F (once popular choices) are no longer available to new Medicare beneficiaries who became eligible after January 1, 2020. This change has increased the popularity of Plan G, which offers similar coverage to Plan F but doesn’t cover the Part B deductible.

Eligibility Requirements

To qualify for Medigap, you must enroll in both Medicare Part A and Part B. The optimal time to enroll is during your Medigap Open Enrollment Period, which begins on the first day of the month when you’re 65 or older and enrolled in Medicare Part B. This period lasts for six months and provides guaranteed issue rights, meaning insurance companies can’t deny you coverage or charge higher premiums based on your health status.

Enrollment Considerations

If you miss the Open Enrollment window, you may still enroll, but you might face medical underwriting and potentially higher premiums. Some states (such as Connecticut, Massachusetts, and New York) allow Medigap enrollment at any time without considering preexisting conditions, offering more flexibility for residents.

State-Specific Variations

Medigap policies and regulations can vary by state. For instance, some states require community-rated premiums for policyholders over 65, while others have different rules regarding guaranteed issue rights. It’s essential to check the specific regulations in your state when considering a Medigap policy.

As we move forward, let’s explore another type of insurance that often gets confused with Medigap: supplemental insurance. Understanding the differences between these two types of coverage will help you make an informed decision about your healthcare protection.

What Is Supplemental Insurance

Definition and Scope

Supplemental insurance complements primary health insurance plans. Unlike Medigap, which caters specifically to Medicare beneficiaries, anyone can purchase supplemental insurance to address gaps in their existing health coverage.

Common Types of Supplemental Insurance

Critical Illness Insurance

This policy provides a lump sum payment upon diagnosis of specific serious illnesses covered by the policy.

Accident Insurance

This coverage pays out for injuries resulting from accidents.

Hospital Indemnity Insurance

This policy pays a set amount for each day of hospitalization.

Distinctive Features and Benefits

Supplemental insurance offers unique characteristics that distinguish it from traditional health insurance and Medigap policies:

- Customization: Unlike standardized Medigap plans, supplemental insurance allows tailoring to specific needs. You select coverage types based on your health concerns and financial situation.

- Direct Benefit Payments: Many supplemental policies pay benefits directly to the policyholder (not to healthcare providers). This allows for flexible use of funds, whether for medical expenses, daily living costs, or income replacement.

- Cost-Effective Premiums: Supplemental insurance often comes with lower premiums compared to comprehensive health insurance or Medigap policies.

- Portability: Many supplemental policies offer portability, allowing you to maintain coverage even when changing jobs or retiring. This provides continuity not always available with employer-sponsored health plans.

While supplemental insurance offers additional protection, it does not replace comprehensive health coverage or Medigap policies. Instead, it works alongside these primary forms of insurance to provide an extra layer of financial security.

As we transition to comparing Medigap and supplemental insurance, it’s important to note that each type of coverage serves distinct purposes in the healthcare landscape. Understanding these differences will help you make informed decisions about your insurance needs.

How Medigap and Supplemental Insurance Compare

Distinct Roles in Healthcare Coverage

Medigap and supplemental insurance fill gaps in primary insurance but serve different purposes and target different demographics. Medigap is extra insurance you can buy from a private health insurance company to help pay your share of out-of-pocket costs in Original Medicare. These policies are available only to Medicare beneficiaries. Supplemental insurance, however, complements various types of primary health insurance and is available to individuals of all ages.

The Kaiser Family Foundation reports that 42% of traditional Medicare beneficiaries had a Medigap policy in 2022, highlighting the popularity of Medigap among seniors seeking comprehensive coverage.

Cost Structures and Considerations

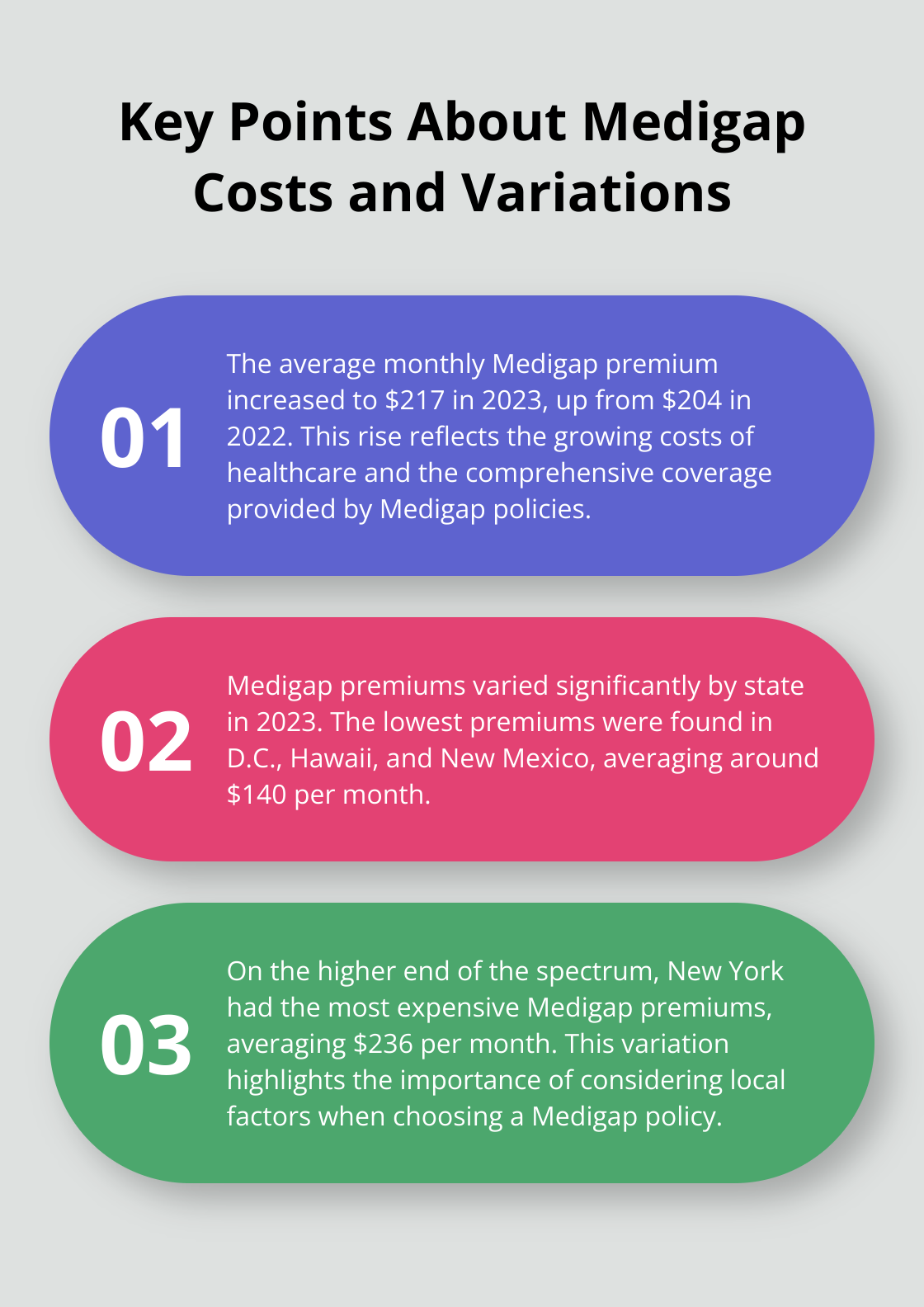

Medigap policies typically have higher monthly premiums compared to many supplemental insurance options. In 2023, the average monthly Medigap premium was $217, an increase from $204 in 2022. However, Medigap often provides more comprehensive coverage for Medicare-related expenses.

Supplemental insurance premiums are generally lower, but the coverage is more specific. For example, a critical illness policy might cost $25-$50 per month but only pays out for diagnosed conditions covered by the policy.

Medigap premiums can vary significantly by state. In 2023, they ranged from about $140 in D.C., Hawaii, and New Mexico to $236 in New York. This variation emphasizes the importance of researching local options when considering Medigap coverage.

Flexibility and Customization Options

Supplemental insurance offers more flexibility in terms of customization. Policyholders can choose specific types of coverage based on their individual needs, such as accident insurance or hospital indemnity plans. This allows for a more tailored approach to filling coverage gaps.

Medigap plans, while standardized, offer less customization. However, this standardization makes it easier to compare plans across different insurance providers. Plan G, for example, will offer the same benefits regardless of the insurer, allowing consumers to focus on price and customer service when making their choice.

Eligibility and Enrollment Considerations

Medigap policies have specific eligibility requirements and enrollment periods. The optimal time to enroll is during the Medigap Open Enrollment Period, which begins on the first day of the month when you’re 65 or older and enrolled in Medicare Part B. This period lasts for six months and provides guaranteed issue rights.

Supplemental insurance typically has fewer restrictions on enrollment periods and eligibility. Individuals can often purchase these policies at any time, regardless of age or health status (subject to underwriting).

Coverage Scope and Benefits

Medigap policies focus specifically on covering gaps in Medicare coverage. They help pay for expenses that Original Medicare doesn’t cover, such as copayments, coinsurance, and deductibles.

Supplemental insurance policies can cover a wider range of expenses, depending on the type of policy. For instance, critical illness insurance provides a lump sum payment upon diagnosis of specific serious illnesses, while accident insurance pays out for injuries resulting from accidents.

Final Thoughts

Medigap and supplemental insurance serve distinct roles in healthcare coverage. Medigap policies cater specifically to Medicare beneficiaries, offering standardized plans to cover gaps in Original Medicare. Supplemental insurance provides more flexibility and customization options for individuals of all ages, addressing specific health concerns with typically lower premiums.

The difference between Medigap and supplemental insurance lies in their target audience, coverage scope, and cost structures. Your current health status, financial situation, and long-term healthcare needs should guide your decision between these options. The complexity of these insurance choices highlights the importance of seeking personalized guidance.

We at Dave Silver Insurance specialize in simplifying Medicare enrollment and providing expert advice on Medigap policies. Our team offers tailored recommendations based on your unique health and financial needs. You can confidently select the coverage that best protects your health and financial well-being with professional guidance.