Navigating the world of Medicare can be complex, especially when it comes to Medicare Cost Plan enrollment. At Dave Silver Insurance, we understand the importance of making informed decisions about your healthcare coverage.

This guide will walk you through the process of enrolling in a Medicare Cost Plan, providing you with the essential information you need to make the right choice for your health and financial well-being.

What Are Medicare Cost Plans?

The Basics of Medicare Cost Plans

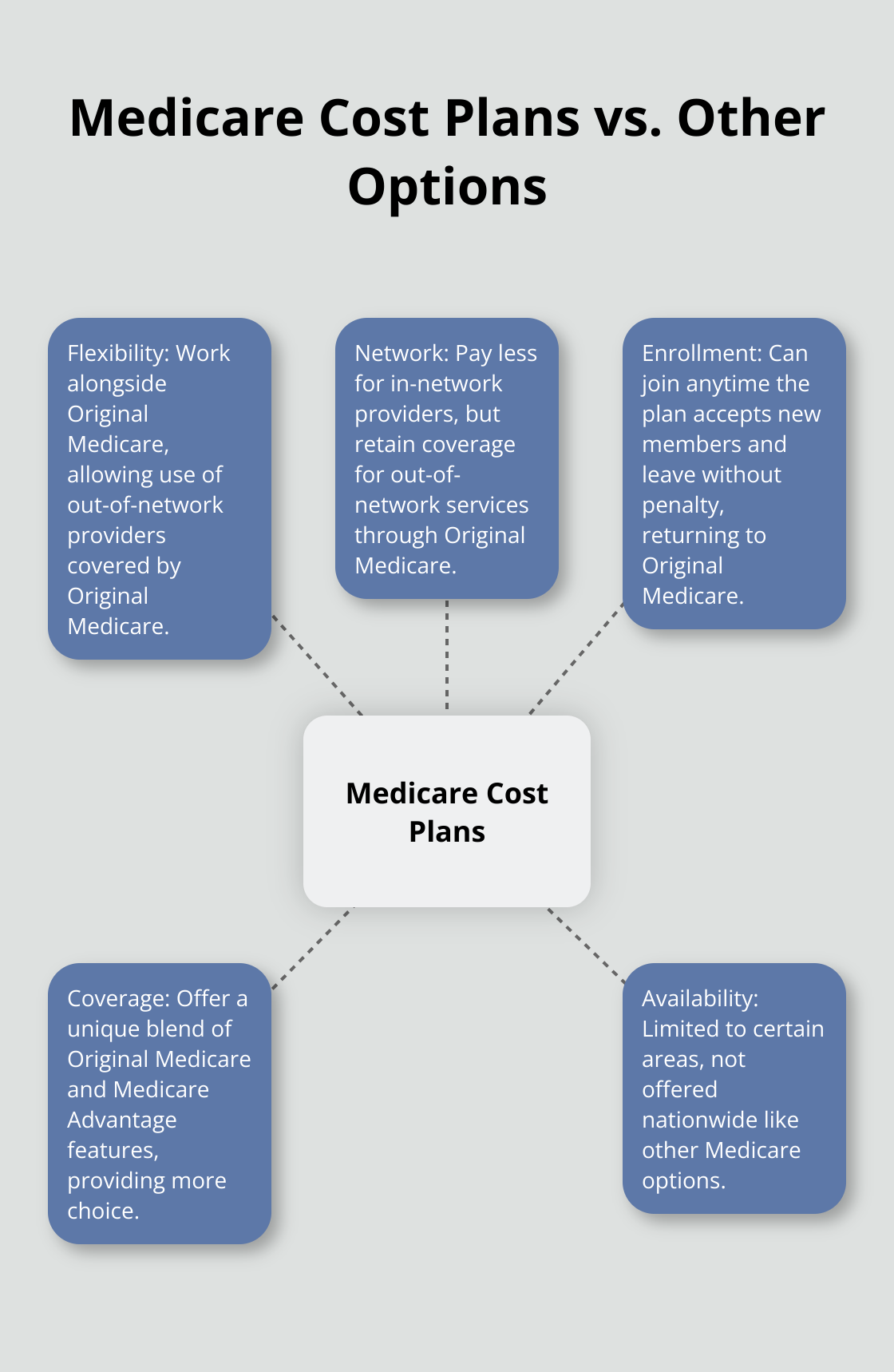

Medicare Cost Plans offer a unique blend of Original Medicare and Medicare Advantage features. These plans, provided by private insurance companies, give beneficiaries more flexibility in their healthcare choices.

Medicare Cost Plans allow you to consider factors such as doctor and hospital choice, cost, coverage, and foreign travel when deciding between Original Medicare and Medicare Advantage. This flexibility sets them apart from other Medicare options. You typically pay less out-of-pocket when you use in-network providers. However, if you choose an out-of-network provider, Original Medicare covers your services.

Comparing Cost Plans to Other Medicare Options

Unlike Medicare Advantage plans, Cost Plans don’t replace Original Medicare. They work alongside it. You keep your Original Medicare coverage, which activates when you use out-of-network services. Medicare Advantage plans, on the other hand, generally restrict you to their network of providers (except in emergencies).

A significant difference is the ability to leave a Medicare Cost Plan at any time and return to Original Medicare without penalty. This option doesn’t exist with Medicare Advantage plans, which have specific enrollment periods for switching coverage.

Geographical Limitations and Availability

Medicare Cost Plans are not available everywhere. As of 2024, these plans are only offered in certain areas of the country. The Centers for Medicare & Medicaid Services (CMS) has phased out Cost Plans in areas with at least two competing Medicare Advantage plans.

For instance, Minnesota (known for high Medicare Cost Plan enrollment) saw many beneficiaries transition to other Medicare options in 2019 due to these changes. It’s essential to check if Cost Plans are available in your area before considering this option.

Enrollment Considerations

Medicare Cost Plans offer more enrollment flexibility than other Medicare options. You can usually join a Cost Plan at any time the plan accepts new members, even if you only have Medicare Part B. However, for prescription drug coverage, you must enroll during specific periods to avoid late enrollment penalties.

As you weigh your Medicare options, consider how a Medicare Cost Plan aligns with your healthcare needs and financial situation. The next section will guide you through the eligibility requirements and enrollment periods for Medicare Cost Plans, helping you determine if this option is right for you.

Who Can Join a Medicare Cost Plan

Eligibility Requirements

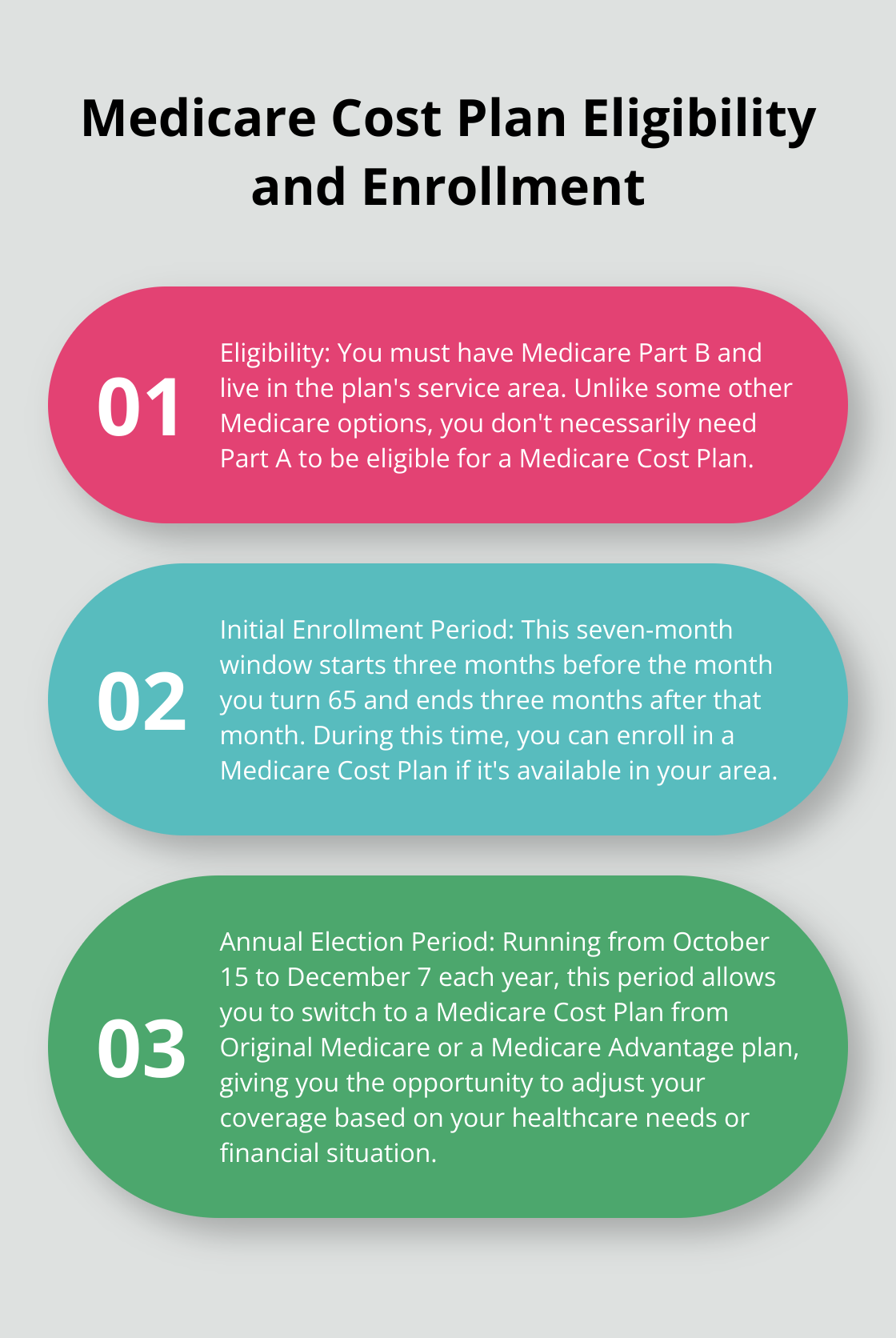

Medicare Cost Plans offer a unique blend of flexibility and coverage, but not everyone qualifies to enroll. To join a Medicare Cost Plan, you must have Medicare Part B. Unlike some other Medicare options, you don’t necessarily need Part A to be eligible. However, you must live in the plan’s service area. As of 2024, these plans are only available in select regions, so it’s essential to check if they’re offered where you live.

Initial Enrollment Period

Your Initial Enrollment Period (IEP) for Medicare starts three months before the month you turn 65 and ends three months after that month. During this seven-month window, you can enroll in a Medicare Cost Plan if it’s available in your area. This period aligns with your eligibility for Original Medicare, but the rules for Cost Plans differ slightly.

Annual Election Period

The Annual Election Period (AEP), also known as Open Enrollment, runs from October 15 to December 7 each year. During this time, you can switch to a Medicare Cost Plan from Original Medicare or a Medicare Advantage plan. This period allows you to change your coverage based on your healthcare needs or financial situation.

Special Enrollment Periods

Special Enrollment Periods (SEPs) allow you to make changes to your Medicare coverage outside of the regular enrollment periods. Various life events can trigger these periods, such as:

- Moving out of your plan’s service area

- Losing other health coverage

- Changes in your plan’s contract with Medicare

SEPs typically last only 60 days from the qualifying event, so it’s important to act quickly if you experience one of these situations.

Considerations for Enrollment

Medicare Cost Plans offer more enrollment flexibility than other Medicare options. You can usually join a Cost Plan at any time the plan accepts new members, even if you only have Medicare Part B. However, for prescription drug coverage, you must enroll during specific periods to avoid late enrollment penalties.

As you weigh your Medicare options, consider how a Medicare Cost Plan aligns with your healthcare needs and financial situation. The flexibility of these plans (including the ability to use out-of-network providers under Original Medicare) can be advantageous for many beneficiaries. However, their limited availability means they’re not an option for everyone.

The next step in your Medicare Cost Plan journey involves understanding the specific steps to enroll. Let’s explore the enrollment process and what you need to do to secure your coverage.

How to Enroll in a Medicare Cost Plan

Research Available Plans

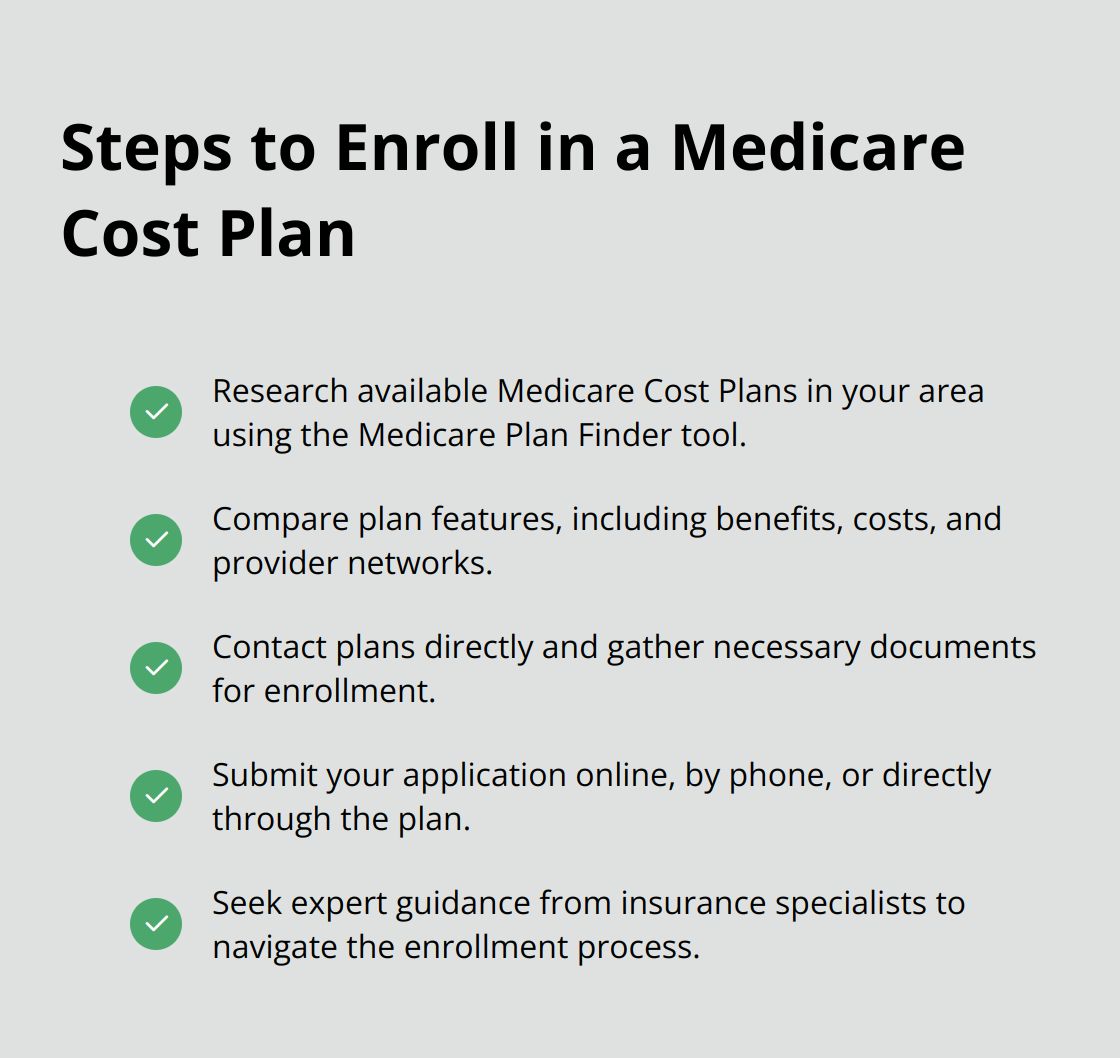

Start by identifying Medicare Cost Plans in your area. These plans are not available everywhere, so you must confirm their availability in your location. Use the Medicare Plan Finder tool as a resource. Enter your zip code to see a list of available plans.

Compare Plan Features

After you identify available plans, examine the details. Look at each plan’s benefits, costs, and provider networks. Focus on:

- Monthly premiums

- Deductibles and copayments

- Coverage for prescription drugs

- Additional benefits (e.g., dental or vision care)

- Provider networks

Medicare Cost Plans allow you to see out-of-network providers, but you’ll typically pay less when using in-network services.

Contact Plans and Gather Information

After you narrow down your options, reach out to the plans directly. Most insurance companies have dedicated helplines for Medicare inquiries. Prepare a list of questions beforehand, focusing on specific aspects of your healthcare needs.

You’ll need certain documents for enrollment:

- Your Medicare card

- Proof of residence

- Information about any other health insurance you may have

Have these ready to streamline the enrollment process.

Submit Your Application

Once you choose a plan, enroll. You can typically do this online through the Medicare website, by calling 1-800-MEDICARE, or by contacting the plan directly. Many find the online process the quickest and most convenient option.

The enrollment form will ask for basic information like your Medicare number, contact details, and sometimes health-related questions. Review all information carefully before you submit.

After submission, you should receive a confirmation of your enrollment. Keep this documentation for your records. The plan will then send you additional information, including your member ID card and details about when your coverage begins.

Seek Expert Guidance

The enrollment process can be complex (but it doesn’t have to be). Expert help is available. We at Dave Silver Insurance specialize in guiding clients through Medicare enrollment, ensuring you understand every step and make the best choice for your healthcare needs. Our team is available seven days a week to answer your questions and provide personalized recommendations based on your unique situation.

Final Thoughts

Medicare Cost Plan enrollment requires careful consideration of your healthcare needs and financial situation. These plans offer a unique blend of flexibility and coverage, allowing you to use both in-network and out-of-network providers. However, their limited availability in certain geographical areas means they’re not an option for everyone.

The process of enrolling in a Medicare Cost Plan involves thorough research, comparison of available plans, and gathering necessary documentation. While you can complete many steps independently, the complexities of Medicare can often feel overwhelming. Expert guidance can prove invaluable in navigating these complexities.

At Dave Silver Insurance, we specialize in simplifying Medicare enrollment (including Cost Plans). Our team offers personalized guidance on all aspects of Medicare. We provide tailored advice based on your unique health and financial needs seven days a week.