Medigap insurance is a crucial supplement to Medicare, but many people wonder about its cost. At Dave Silver Insurance, we often hear the question: “What is Medigap insurance and how much does it cost?”

The answer isn’t straightforward, as several factors influence the price of these policies. In this post, we’ll break down the key elements that affect Medigap costs and provide insights to help you make an informed decision.

What Impacts Medigap Insurance Costs?

Age and Enrollment Timing

Your age significantly affects Medigap premiums. Younger enrollees typically pay lower premiums, especially with issue-age-rated policies. A 2023 Kaiser Family Foundation study revealed the average monthly premium for Medigap Plan G was $164, but this varied widely based on age.

Timing matters too. Enrolling during your Medigap Open Enrollment Period (which starts when you turn 65 and enroll in Medicare Part B) guarantees coverage without health-based surcharges. Missing this window may result in higher premiums or coverage denial.

Geographic Location and State Regulations

Where you live greatly influences your Medigap costs. Urban areas often have higher premiums than rural ones due to healthcare cost differences and insurer competition.

State regulations also impact costs. Some states (Connecticut, Massachusetts, Maine, and New York) have implemented community rating systems. These systems can lead to higher average premiums but protect older beneficiaries from steep increases.

Plan Type and Coverage Level

Your chosen coverage level directly affects your premium. More comprehensive plans like Plan G tend to have higher premiums but lower out-of-pocket costs. High-deductible versions offer lower monthly premiums but require more upfront payment before coverage begins.

Insurance Company and Pricing Methods

Different insurance companies use various pricing methods, leading to significant premium differences for the same plan. The three main pricing methods are:

- Community-rated: All policyholders pay the same premium regardless of age.

- Issue-age-rated: Premiums are based on your age when you purchase the policy.

- Attained-age-rated: Premiums increase as you get older.

Understanding these factors will help you navigate the complex world of Medigap insurance costs. In the next section, we’ll explore the average costs of different Medigap plans to give you a clearer picture of what you might expect to pay.

What Are the Average Costs of Medigap Plans?

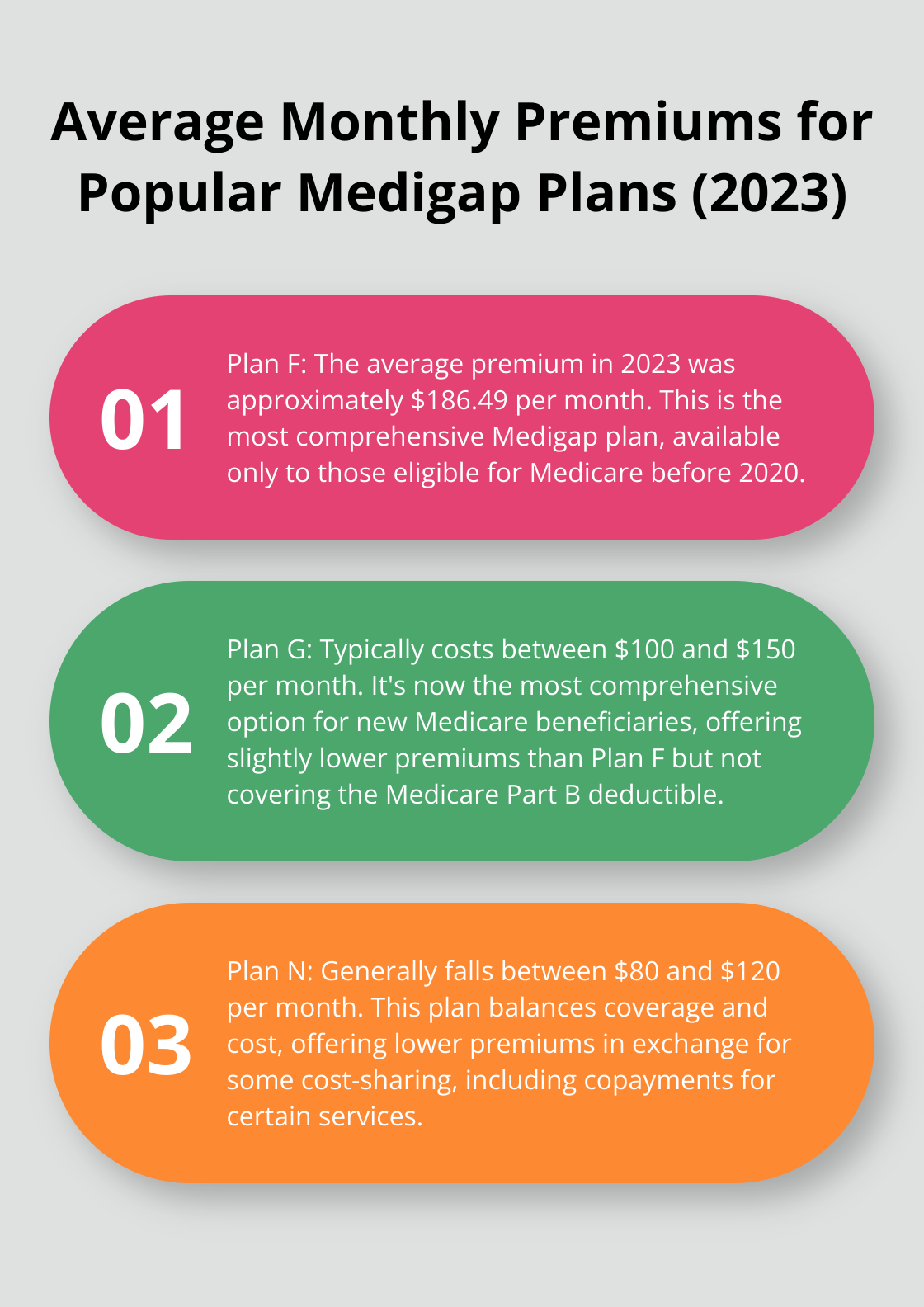

Plan F and Plan G: The Comprehensive Options

Plan F’s average premium in 2023 was roughly $186.49 per month, or $2,237.88 per year. Plan F, available only to those eligible for Medicare before 2020, stands as the most comprehensive Medigap plan.

Plan G, now the most comprehensive option for new Medicare beneficiaries, typically costs between $100 and $150 per month. We observe premiums as low as $90 and as high as $220 in some areas. Plan G offers slightly lower premiums than Plan F but doesn’t cover the Medicare Part B deductible.

Plan N: A Cost-Effective Alternative

Plan N balances coverage and cost, gaining popularity among beneficiaries. Monthly premiums for Plan N generally fall between $80 and $120. This plan offers lower premiums in exchange for some cost-sharing, including copayments of up to $20 for office visits and $50 for emergency room visits.

Age-Based Cost Comparisons

Age significantly impacts Medigap premiums. Here’s a general breakdown:

- Ages 65-69: Premiums are typically 15-20% lower than the average.

- Ages 70-74: Expect to pay close to the average premium rates.

- Ages 75 and up: Premiums can be 15-30% higher than the average (depending on the pricing method used).

For example, a 65-year-old might pay around $120 for Plan G, while a 75-year-old could pay $180 or more for the same plan.

State-Specific Variations

These averages vary dramatically by state. The Kaiser Family Foundation reports that the average Plan G premium in New York was $236 in 2023, while in Hawaii it was only $140. This substantial difference underscores the importance of checking rates specific to your area.

Clients who compare quotes from multiple insurers often find savings of 20-30% on their premiums. This can translate to hundreds of dollars in annual savings, making it worthwhile to explore your options thoroughly.

The average costs provide a starting point for your Medigap insurance search. However, your individual circumstances will ultimately determine your actual premiums. The next section will discuss strategies to help you reduce your Medigap insurance costs and find the best value for your healthcare needs.

How to Reduce Medigap Insurance Costs

Compare Multiple Quotes

You can save significantly on Medigap insurance by comparing quotes from different insurers. Premiums for identical plans can vary widely between companies. The Kaiser Family Foundation reports that prices for Plan G can range from $90 to $220 per month (depending on the insurer and location).

We suggest you obtain quotes from at least three different insurance companies. This approach might take some time, but it can result in substantial savings. Many individuals have saved 20-30% on their premiums through this method.

Consider High-Deductible Plans

If you’re in good health and don’t expect to need frequent medical care, a high-deductible Medigap plan could save you money. High-deductible Plan G has lower premiums than the regular Medigap Plan G, with both covering the same benefits.

In 2025, the deductible for high-deductible Plan G is $2,870. You’ll need to pay this amount out-of-pocket before your Medigap coverage begins. While this higher initial cost might seem daunting, the lower monthly premiums can lead to significant savings over time, especially if you don’t require extensive medical services.

Take Advantage of Household Discounts

Many insurance companies offer household discounts for Medigap policies. These discounts typically range from 5% to 12% off your monthly premium if you and your spouse both have Medigap policies with the same insurer.

Some companies even offer these discounts if you live with someone who has a Medigap policy (even if you’re not married). Always ask about available discounts when getting quotes – you might find unexpected savings opportunities.

Enroll at the Right Time

The timing of your Medigap enrollment can significantly impact your costs. You should enroll during your Medigap Open Enrollment Period, which starts when you turn 65 and enroll in Medicare Part B. This period guarantees you the best rates. During this time, insurance companies can’t charge you higher premiums based on your health status.

If you miss this window, you might face higher premiums or even be denied coverage. The American Association for Medicare Supplement Insurance states that premiums can be 30-50% higher if you enroll outside of your Open Enrollment Period.

Maintain a Healthy Lifestyle

Some insurance companies offer discounts for non-smokers or individuals who maintain a healthy weight. You can potentially reduce your Medigap premiums by adopting healthy habits. Regular exercise, a balanced diet, and avoiding tobacco use not only improve your health but might also lead to lower insurance costs.

Consider Different Plan Options

Some Medigap plans offer lower premiums but higher out-of-pocket costs for care, while others present higher premiums with lower copayments. Carefully evaluate your healthcare needs and financial situation to choose the most cost-effective option for you.

Final Thoughts

Medigap insurance costs depend on various factors such as age, location, plan type, and insurance company. You can reduce your premiums by comparing quotes, considering high-deductible plans, and taking advantage of discounts. Your health needs, financial situation, and personal preferences will determine the best Medigap plan for you.

If you ask “What is Medigap insurance and how much does it cost?” for your specific situation, we at Dave Silver Insurance can help. We offer expert guidance tailored to your individual needs. Our team is available seven days a week to answer your questions and compare plans.

Don’t let Medigap insurance complexity overwhelm you. Contact us for a consultation, and we’ll help you navigate your options with clarity and confidence. Your health and financial well-being deserve careful consideration when choosing the right Medigap plan for your unique circumstances.