Navigating the world of Medicare can be complex, especially when it comes to supplemental coverage. Many people wonder, “Can I buy Medigap insurance at any time?”

At Dave Silver Insurance, we often hear this question from our clients. The answer isn’t always straightforward, as there are specific enrollment periods and circumstances that can affect your ability to purchase Medigap policies.

In this post, we’ll explore the ins and outs of Medigap enrollment, helping you understand when and how you can secure this valuable coverage.

What Is Medigap Insurance?

Bridging the Gaps in Original Medicare

Medigap insurance (also known as Medicare Supplement Insurance) serves as a vital component of healthcare coverage for many Medicare beneficiaries. This type of insurance fills the “gaps” in Original Medicare (Part A and Part B) coverage, which include out-of-pocket costs such as deductibles, copayments, and coinsurance. For instance, if you require a hospital stay, Medicare Part A covers a significant portion of the cost, but you remain responsible for a deductible. A Medigap policy can cover this deductible, potentially saving you thousands of dollars.

Standardized Plans for Easy Comparison

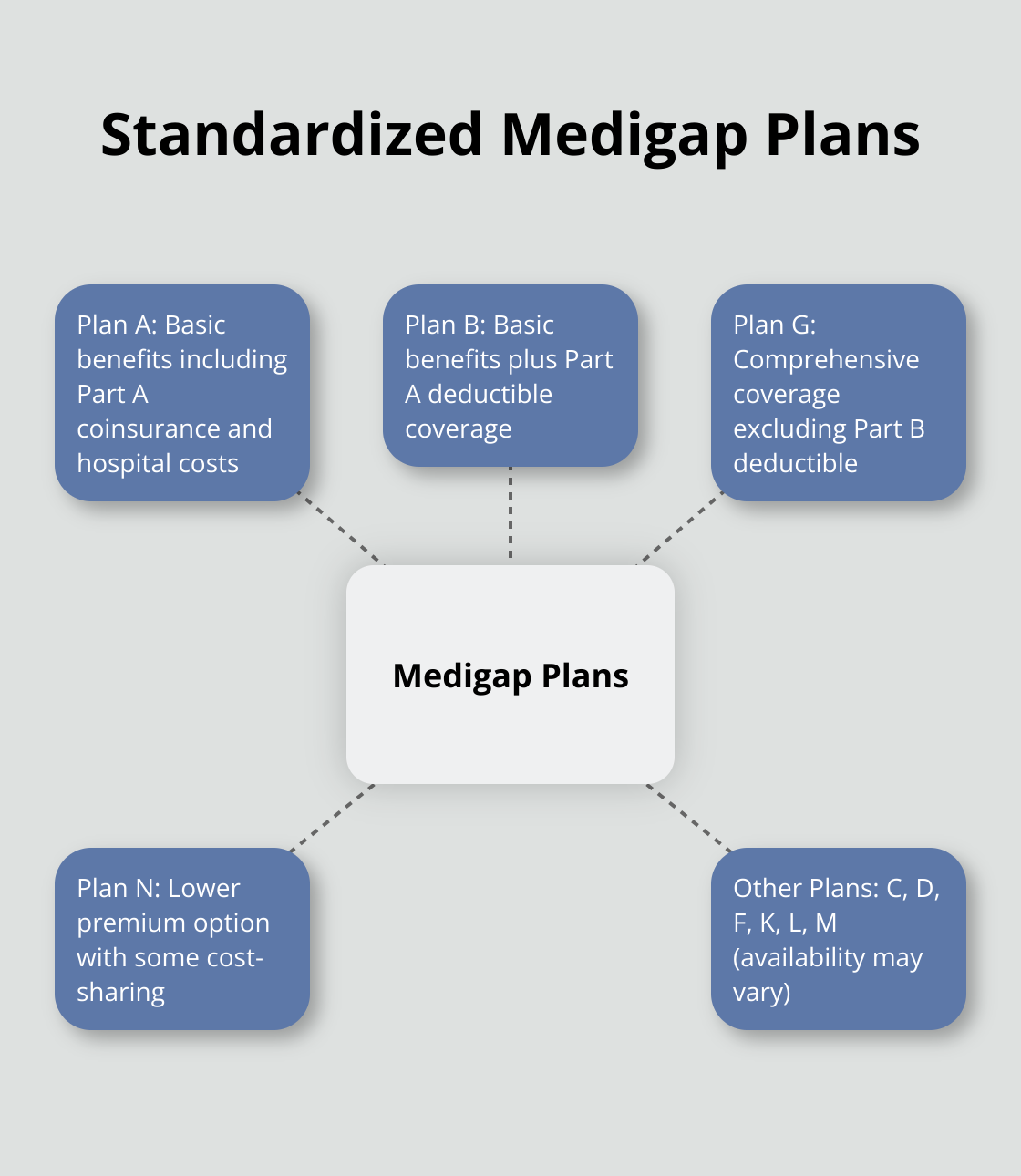

One of the most user-friendly aspects of Medigap insurance is its standardization. In most states, there are up to 10 standardized plans (labeled A through N). This standardization ensures that Plan G from one insurance company offers the same basic benefits as Plan G from another company. The primary differences lie in the cost and the insurance company’s customer service.

A Financial Safety Net

The importance of Medigap in supplementing Original Medicare cannot be understated. A recent study revealed that beneficiaries in traditional Medicare without additional coverage face the risk of high annual out-of-pocket costs. With a Medigap policy, this amount can significantly decrease, providing a financial safety net for unexpected medical expenses.

Real-World Impact

Many insurance professionals have witnessed firsthand how Medigap policies provide peace of mind to their clients. While the monthly premium for a Medigap policy is an additional cost, the potential savings in out-of-pocket expenses can far outweigh this investment (especially for those who frequently use medical services).

As we move forward, it’s essential to understand when you can purchase this valuable coverage. The next section will explore the Medigap Open Enrollment Period and its significance in securing the best possible coverage.

When Can You Enroll in Medigap?

The Critical Medigap Open Enrollment Period

The Medigap Open Enrollment Period stands as a pivotal time for Medicare beneficiaries. This six-month window starts on the first day of the month you turn 65 and enroll in Medicare Part B. During this period, you enjoy the most flexibility and protection when purchasing a Medigap policy.

Advantages of Timely Enrollment

Enrolling during your Medigap Open Enrollment Period offers substantial benefits. Insurance companies cannot deny you coverage or charge higher premiums based on your health status. This means you can secure a policy regardless of pre-existing conditions (a valuable advantage for those with ongoing health issues).

Financial Protection Through Early Action

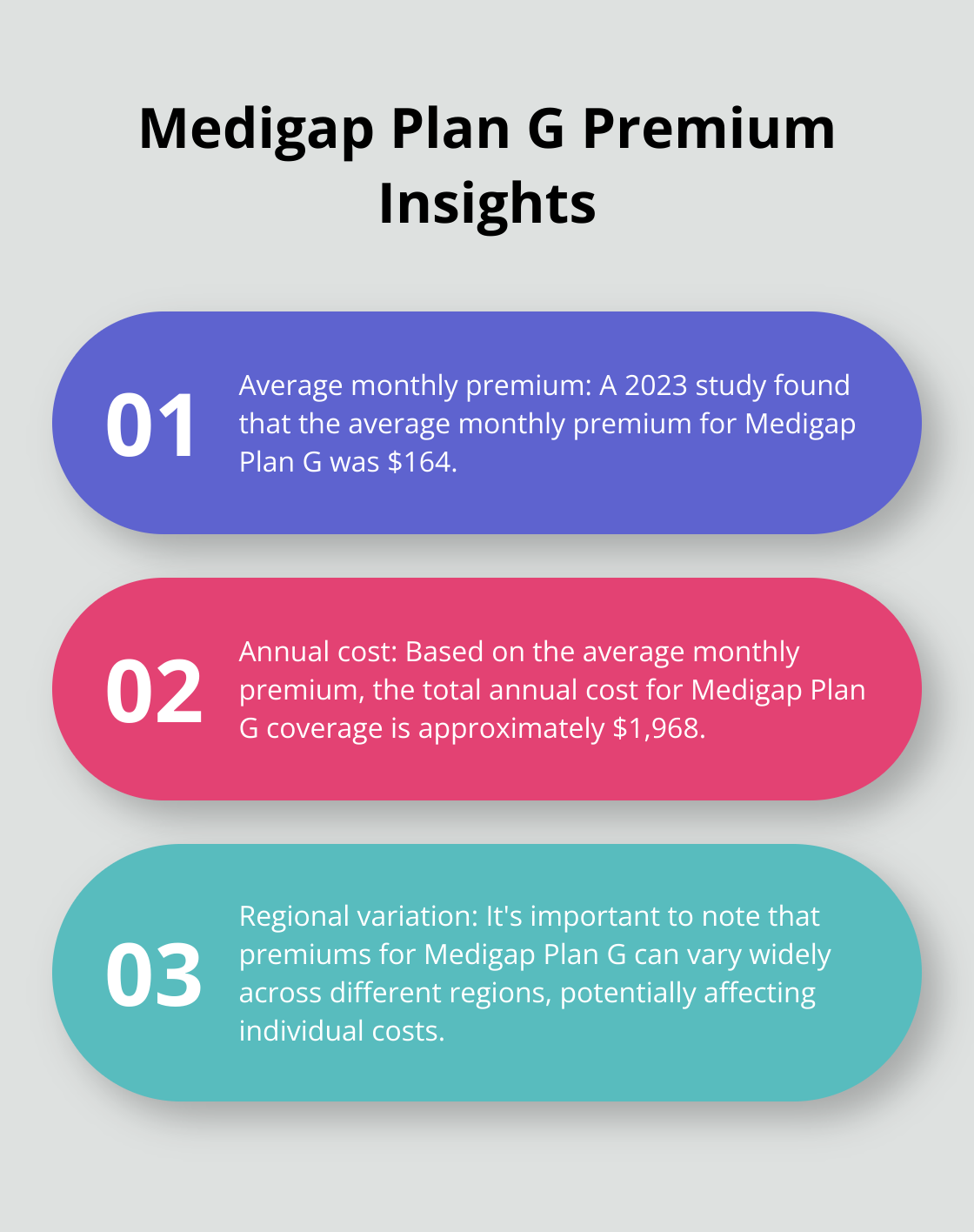

Outside of this enrollment period, insurers may use medical underwriting to assess your health risks. This process can result in higher premiums or even denial of coverage. A 2023 study found that the average monthly premium for people enrolled in Plan G was $164 ($1,968 for 12 months), but this varied widely across different regions.

Understanding Guaranteed Issue Rights

During the Open Enrollment Period, you have guaranteed issue rights. Insurance companies must sell you a Medigap policy, cover all your pre-existing conditions, and cannot charge you more for coverage because of past or present health problems.

State-Specific Regulations

It’s important to note that some states have additional regulations that extend these protections. For example, in New York and Connecticut, Medigap policies are guaranteed issue year-round. Always check with your state’s insurance department for specific rules that may apply to you.

As you approach Medicare eligibility, mark your calendar and prepare to make this important decision. While it’s possible to purchase Medigap insurance outside of this period, doing so during your Open Enrollment window provides the most options and financial protection. However, what happens if you miss this crucial window? Let’s explore the options for purchasing Medigap outside of the Open Enrollment Period in the next section.

Navigating Medigap Enrollment After Open Enrollment

The Challenge of Late Enrollment

If you missed your Medigap Open Enrollment Period, you still have options. However, enrolling outside this window presents unique challenges and considerations.

Medical Underwriting and Its Effects

Insurance companies typically use medical underwriting to assess your health status when you apply for Medigap insurance outside the Open Enrollment Period. This process evaluates an applicant’s risk level for coverage approval and determines premium rates. Based on this assessment, insurers might:

- Charge higher premiums

- Impose waiting periods for coverage of pre-existing conditions

- Deny coverage altogether

Guaranteed Issue Rights: A Potential Lifeline

Specific situations may qualify you for guaranteed issue rights even outside the Open Enrollment Period. These rights require insurance companies to:

- Sell you a Medigap policy

- Cover all pre-existing conditions

- Avoid charging more based on your health status

Common scenarios that trigger guaranteed issue rights include:

Act quickly if you find yourself in one of these situations, as guaranteed issue rights typically last for 63 days after the qualifying event.

Strategies to Overcome Enrollment Hurdles

If you consider Medigap insurance outside the Open Enrollment Period and don’t qualify for guaranteed issue rights, try these strategies to improve your chances of securing coverage:

- Shop extensively: Premium rates can vary significantly between insurance companies, even for the same plan.

- Consider high-deductible plans: These often have lower premiums and may prove more accessible to those with health issues.

- Investigate state-specific protections: Some states offer additional enrollment opportunities or protections for Medigap applicants. (For instance, New York and Connecticut have continuous open enrollment for Medigap policies.)

- Work with an experienced insurance agent: Professionals who specialize in Medicare can provide valuable insights into your options and help you navigate the application process.

The Value of Expert Guidance

Navigating the complexities of Medicare and supplemental insurance can prove challenging. An experienced insurance agent (like those at Dave Silver Insurance) can offer valuable assistance in your search for coverage, even when faced with difficult circumstances.

Final Thoughts

Medigap insurance offers valuable protection for Medicare beneficiaries. You can buy Medigap insurance at any time, but the best period to enroll is during your Medigap Open Enrollment Period. This six-month window provides optimal protection and flexibility for securing coverage without facing higher premiums or potential denials.

Professional assistance proves invaluable when you navigate Medicare and Medigap policies. At Dave Silver Insurance, we offer personalized guidance to help you understand your options. Our team has extensive experience in Medicare enrollment and can provide tailored advice based on your health and financial needs.

We encourage you to seek expert help for your Medicare decisions. Our agents can assist you in understanding when and how to enroll in Medigap insurance (ensuring you make informed choices about your healthcare coverage). Don’t hesitate to contact Dave Silver Insurance for clarity and confidence in your Medicare journey.