At Dave Silver Insurance, we often hear the question: Is Medigap insurance worth the cost? It’s a valid concern for many seniors navigating the complex world of Medicare coverage.

In this post, we’ll break down the costs and benefits of Medigap insurance, helping you make an informed decision about your healthcare coverage. We’ll explore how Medigap can provide financial protection and peace of mind, while also considering individual health needs and financial situations.

What Is Medigap Insurance?

The Basics of Medigap

Medigap insurance (also known as Medicare Supplement Insurance) fills the ‘gaps’ in Original Medicare coverage. These gaps include deductibles, copayments, and coinsurance that you would otherwise pay out of pocket. In 2022, 12.5 million Medicare beneficiaries (42%) had a Medigap policy, according to a Kaiser Family Foundation report. This high adoption rate highlights the importance of supplemental coverage in managing healthcare costs.

Available Medigap Plans

There are 10 standardized Medigap plans available, labeled A through N. Each plan offers a different level of coverage, allowing you to choose based on your specific health needs and budget. In 2023, Plan G was the most popular, covering about 39% of all policyholders. This plan covers most out-of-pocket costs (except for the Medicare Part B deductible).

Medigap vs. Original Medicare

Original Medicare (Parts A and B) covers many healthcare services but doesn’t cap out-of-pocket spending. Medigap addresses this issue. For instance, if you’re hospitalized, Original Medicare requires you to pay a deductible of $1,600 in 2023. Most Medigap plans cover this deductible, potentially saving you thousands of dollars.

Medigap also offers flexibility that Original Medicare doesn’t provide. You can see any doctor who accepts Medicare without needing referrals. This freedom of choice benefits seniors who travel or have specific healthcare provider preferences.

Key Differences from Medicare Advantage

It’s essential to understand that Medigap is not the same as Medicare Advantage (Part C). Medicare Advantage replaces Original Medicare, while Medigap supplements it. This distinction plays a critical role when you decide on your Medicare coverage strategy.

Choosing the Right Coverage

Selecting the appropriate Medigap plan requires careful consideration of your health needs and financial situation. At Dave Silver Insurance, we offer personalized guidance to help you navigate these choices. Our team of experts can provide tailored recommendations based on your unique circumstances, ensuring you make an informed decision about your healthcare coverage.

As we move forward, let’s examine the costs associated with Medigap insurance and how they compare to potential out-of-pocket expenses without this supplemental coverage.

What Drives Medigap Insurance Costs?

Age and Pricing Models

Medigap insurance premiums vary based on several factors. Your age significantly influences these premiums. Insurance companies use three main pricing models:

- Community-rated: All policyholders pay the same premium regardless of age.

- Issue-age-rated: Premiums are set based on your age when you purchase the policy and do not increase due to aging.

- Attained-age-rated: Premiums start low but increase as you age.

Plan G is the most popular Medigap policy, accounting for 39% of all policyholders, or nearly 5.3 million people, in 2023.

Geographic Variations

Your location plays a major role in determining Medigap costs. For example, a 65-year-old woman in Houston might pay $5,300 annually for Medigap Plan C, while the same coverage in a different state could cost only $1,700. This stark difference highlights the importance of comparing rates in your specific area.

Plan Type and Coverage Level

The Medigap plan you select directly affects your premium. In 2023, the average monthly premium for Medigap Plan G (the most popular option) was $164. However, this amount varied from $140 in some states to $236 in New York. Plans with more comprehensive coverage typically have higher premiums but lower out-of-pocket costs when you need care.

Comparing Costs: Medigap vs. No Supplemental Coverage

To assess if Medigap is worth the cost, we must consider potential out-of-pocket expenses without it. Medicare has no limit on out-of-pocket spending, which can lead to significant financial risk. For instance, a prolonged hospital stay could result in thousands of dollars in copayments and deductibles.

A study by the Kaiser Family Foundation found that beneficiaries with Medigap were less likely to experience cost-related issues compared to those without supplementary coverage. This suggests that while Medigap premiums represent an ongoing expense, they can provide valuable financial protection against unexpected medical costs.

The Long-Term Financial Picture

When evaluating Medigap costs, it’s important to consider long-term financial implications. While premiums may seem high initially, they can potentially save you thousands over time by covering out-of-pocket expenses. For instance, the Medicare Part A deductible alone is $1,600 per benefit period in 2023 (which most Medigap plans cover fully).

As we move forward, let’s explore the specific benefits that Medigap insurance offers and how these advantages might justify the costs for many Medicare beneficiaries.

Why Medigap Insurance Is a Smart Investment

Financial Shield Against High Medical Costs

Medigap insurance offers substantial benefits that often outweigh its costs. This supplemental coverage provides a financial buffer, protecting you from potentially devastating out-of-pocket expenses. Without this coverage, you could face significant costs for extended hospital stays, skilled nursing care, or frequent doctor visits. For example, a 20-day stay in a skilled nursing facility could cost you over $3,500 in copayments under Original Medicare alone. Most Medigap plans cover these copayments entirely, potentially saving you thousands of dollars in a single health event.

Predictable Healthcare Expenses

One of the most valuable aspects of Medigap is the predictability it brings to your healthcare budget. Instead of worrying about fluctuating medical costs, you pay a set premium and can better plan your finances. This predictability is especially important for retirees on fixed incomes. A study by the Employee Benefit Research Institute found that healthcare costs are one of the most significant expenses in retirement, with the average 65-year-old couple needing $300,000 saved for medical expenses alone.

Expanded Provider Access

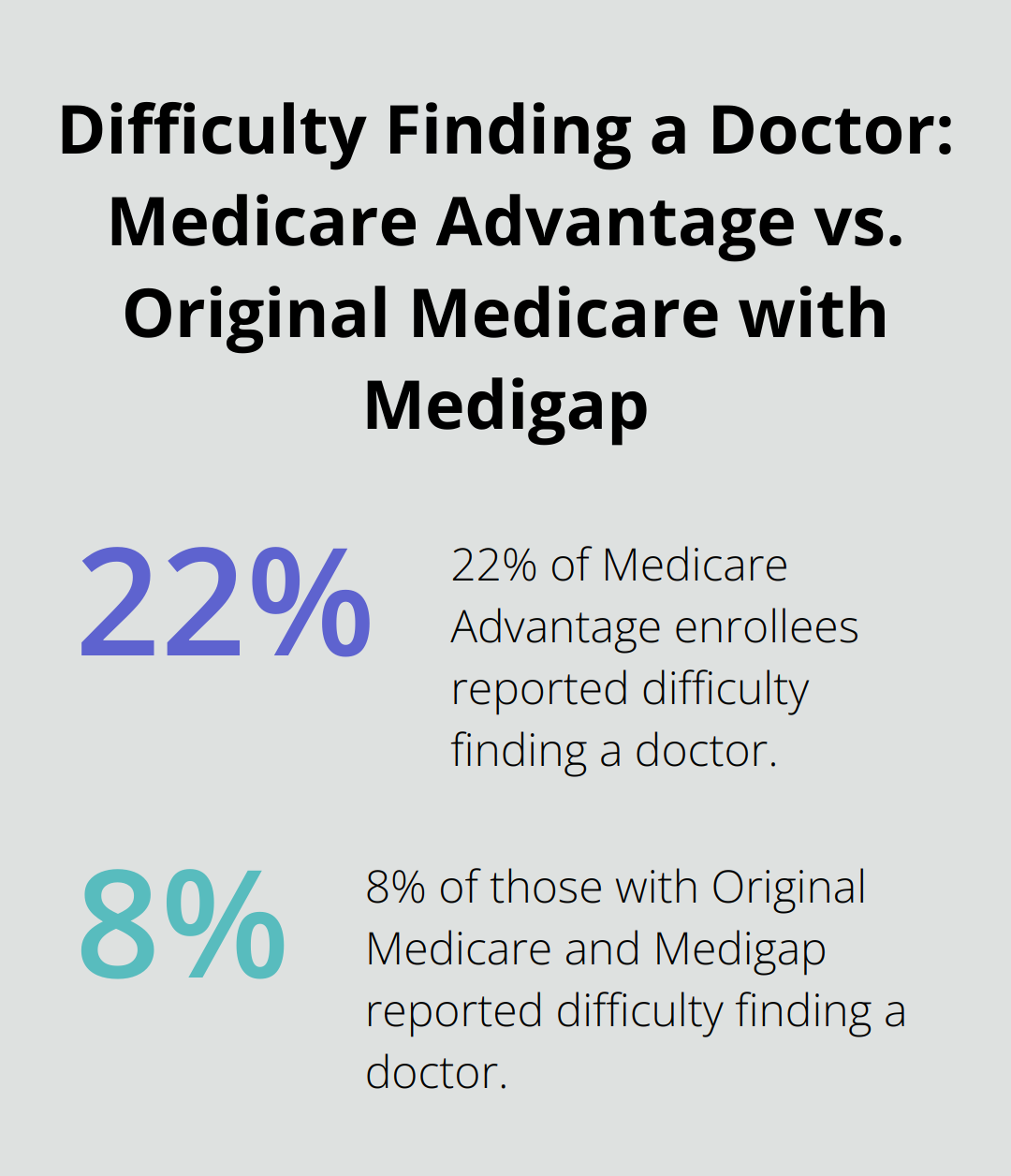

Medigap plans offer the freedom to see any healthcare provider that accepts Medicare, without the need for referrals. This flexibility benefits those who travel frequently or split their time between different locations. It’s also invaluable if you have specific healthcare needs that require specialized care not available in limited networks. A survey by the Kaiser Family Foundation found that 22% of Medicare Advantage enrollees reported difficulty finding a doctor (compared to only 8% of those with Original Medicare and a supplemental plan like Medigap).

Coverage Beyond Original Medicare

Medigap plans often cover services that Original Medicare doesn’t. For example, most Medigap plans offer foreign travel emergency coverage, which can be a lifesaver if you fall ill while abroad. A medical evacuation from Europe to the U.S. can cost upwards of $50,000 – a sum that could be covered by your Medigap plan, saving you from potential financial ruin.

Moreover, some Medigap plans cover the Medicare Part B excess charges. These are extra fees charged by a doctor, provider or supplier that doesn’t accept Medicare assignment. Medigap protects you from unexpected bills and gives you more freedom in choosing your healthcare providers.

Final Thoughts

Medigap insurance offers significant advantages that often outweigh its premium costs. The financial protection, predictability, and expanded access to healthcare providers make it a worthwhile investment for many Medicare beneficiaries. However, the decision to purchase Medigap insurance depends on individual health needs, financial situations, and risk tolerance.

We at Dave Silver Insurance specialize in helping seniors navigate these important decisions. Our team of experts provides tailored recommendations based on your unique circumstances (ensuring you make an informed choice about your healthcare coverage). You can find more information and personalized advice at Dave Silver Insurance.

The question “Is Medigap insurance worth the cost?” has a different answer for each individual. You should take the time to understand your options and seek expert guidance. This approach will help you make a decision that provides the best possible healthcare coverage for your unique situation.