At Dave Silver Insurance, we often encounter questions about Medicare’s Late Enrollment Penalty. Many people wonder why there’s a penalty for late enrollment in Medicare.

This penalty can significantly impact your healthcare costs, making it crucial to understand its purpose and how to avoid it.

In this post, we’ll explore the reasons behind this penalty and provide practical advice on enrolling at the right time.

What Is the Late Enrollment Penalty?

The Basics of the Late Enrollment Penalty

Medicare imposes a Late Enrollment Penalty as a financial consequence for delayed enrollment in specific parts of the program. This penalty applies to Medicare Part A (if you’re not eligible for premium-free Part A), Part B, and Part D.

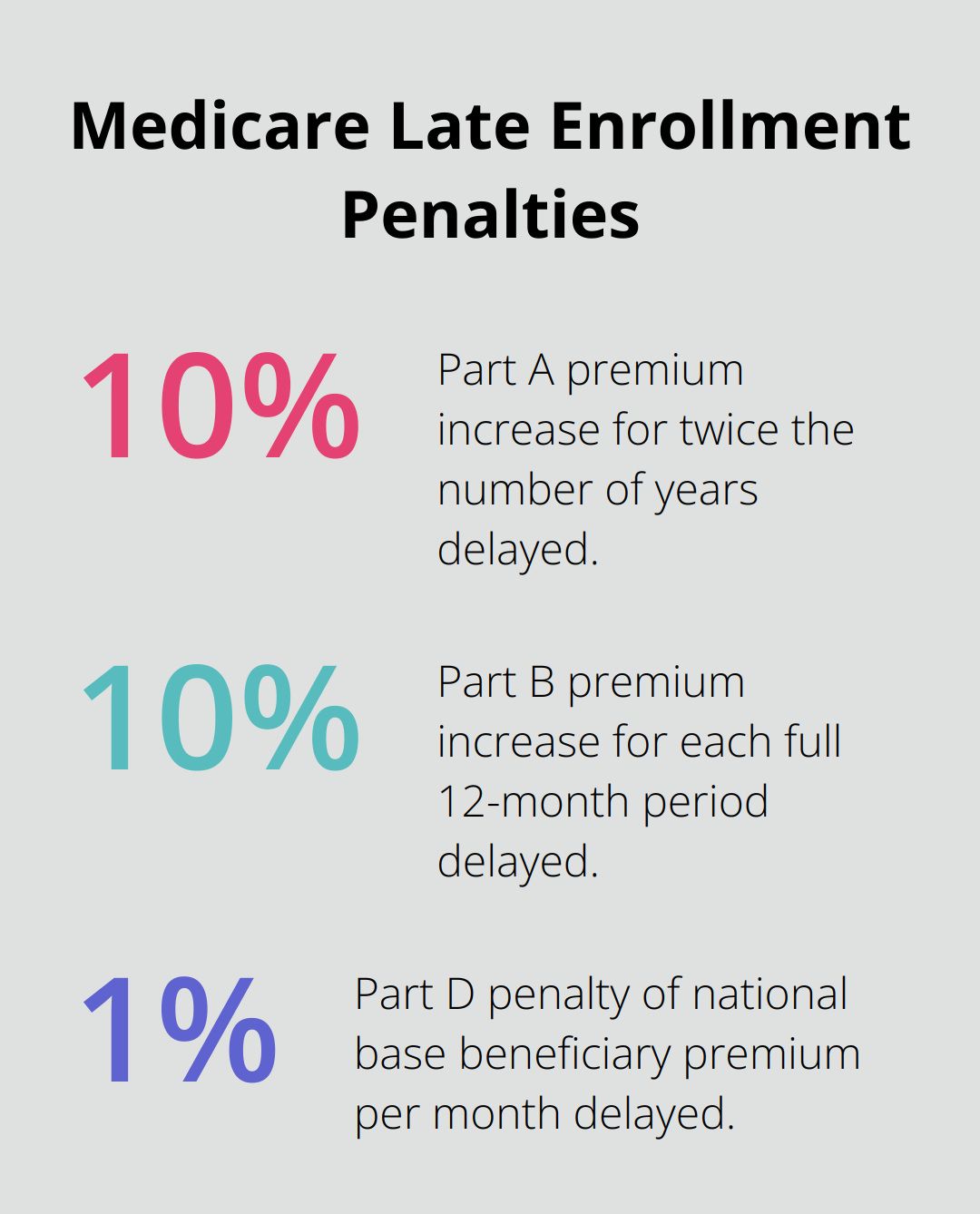

For Part A, the penalty increases your monthly premium by 10% for twice the number of years you delayed enrollment. Part B penalties are more severe, with a 20% increase (10% for each full 12-month period that you could have signed up), plus the standard Part B monthly premium. Part D penalties are calculated at 1% of the national base beneficiary premium ($36.78 in 2025) for each month of delay.

When the Penalty Takes Effect

Your Initial Enrollment Period (IEP) marks the start of your Medicare eligibility. This 7-month window begins 3 months before the month you turn 65, includes your birth month, and extends 3 months after. If you miss this window and don’t qualify for a Special Enrollment Period, you’ll face penalties when you do enroll.

The Long-Term Impact of the Penalty

These penalties aren’t one-time fees. They add to your monthly premiums for as long as you have Medicare coverage. For many, this translates to paying higher premiums for life.

Exceptions to the Rule

Certain situations allow you to avoid the penalty. If you’re still working and covered by an employer’s group health plan, you may qualify for a Special Enrollment Period when that coverage ends. Veterans with VA health benefits might also be exempt from Part D penalties. However, it’s important to verify your specific situation to ensure you’re not unknowingly accruing penalties.

The Importance of Timely Enrollment

The Late Enrollment Penalty underscores the significance of timely Medicare enrollment. It’s not just about avoiding extra costs; it’s about ensuring continuous health coverage as you age. Many people find the enrollment process complex and confusing, which can lead to costly mistakes. That’s why it’s often beneficial to consult with Medicare experts (like those at Dave Silver Insurance) who can provide personalized guidance based on your unique circumstances.

As we move forward, let’s explore the reasons behind this penalty and why Medicare implemented it in the first place.

Why Medicare Penalizes Late Enrollees

Encouraging Prompt Enrollment

Medicare’s Late Enrollment Penalty serves as a powerful incentive for eligible individuals to sign up as soon as they qualify. This policy doesn’t just streamline administrative processes; it ensures continuous health coverage for aging Americans. In 2021, about 779,400 people with Medicare were paying a Part B Late Enrollment Penalty (LEP), highlighting the need for better understanding of enrollment periods and timely action.

Safeguarding Medicare’s Financial Health

The financial stability of Medicare hinges on a consistent influx of new enrollees. Delayed enrollments strain the system’s resources significantly. These penalties motivate timely enrollment, which helps maintain a more predictable and stable financial foundation for the program.

Balancing the Risk Pool

Insurance systems thrive on effective risk pooling. When healthier individuals postpone enrollment until they require medical care, it can distort the risk pool, potentially increasing costs for all participants.

Promoting Fairness Among Beneficiaries

The penalty system aims to create equity among Medicare beneficiaries. Those who enroll on time shouldn’t bear the burden of higher costs caused by individuals who delay enrollment until they need extensive medical care. This approach (while sometimes viewed as harsh) helps maintain fairness within the Medicare system.

Educating About Healthcare Planning

The existence of late enrollment penalties serves as an educational tool. It prompts individuals approaching Medicare eligibility to think proactively about their long-term healthcare needs. This forward-thinking approach benefits both the individual and the Medicare system as a whole.

Understanding these reasons can help individuals make more informed decisions about their Medicare enrollment. Planning ahead and considering long-term healthcare needs when approaching Medicare eligibility age not only helps avoid penalties but also contributes to the overall stability and effectiveness of the Medicare system. The next section will explore strategies to avoid these penalties and ensure smooth enrollment in Medicare.

How to Avoid Medicare Late Enrollment Penalties

Avoiding Medicare late enrollment penalties requires careful planning and understanding of the enrollment process. This chapter outlines effective strategies to prevent these costly penalties.

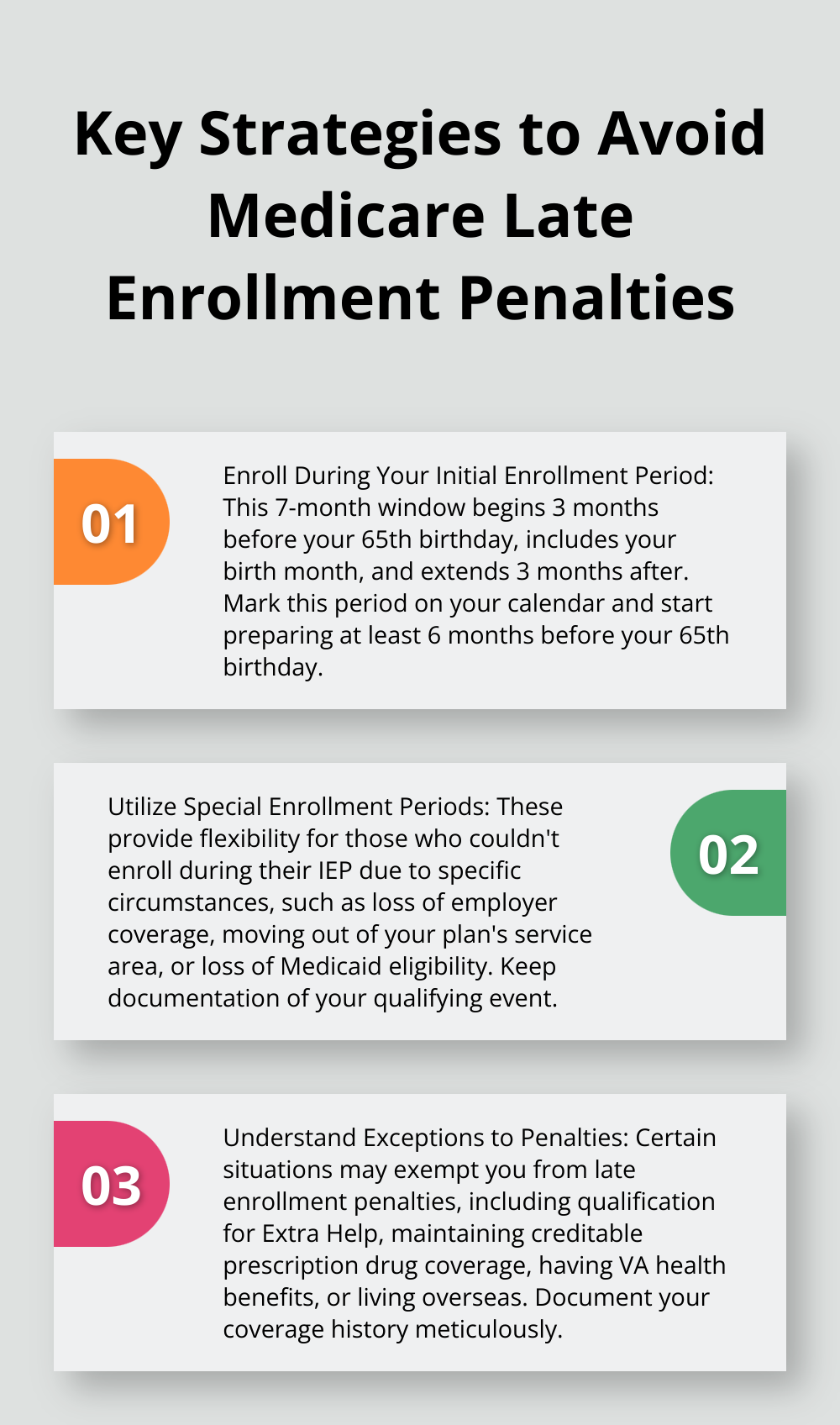

Enroll During Your Initial Enrollment Period

Your Initial Enrollment Period (IEP) spans 7 months around your 65th birthday. It begins 3 months before your birth month, includes your birth month, and extends 3 months after. Mark this period on your calendar and set reminders. Start preparing at least 6 months before your 65th birthday by gathering necessary documents and researching your options.

If you continue to work at 65 and have employer-sponsored health coverage, you might delay enrollment without penalty. However, you must verify that your current coverage meets Medicare’s “creditable” standards. Contact your employer’s benefits department to confirm this information.

Utilize Special Enrollment Periods

Special Enrollment Periods provide flexibility for those who couldn’t enroll during their IEP due to specific circumstances. Common SEPs include:

- Loss of employer coverage: You have an 8-month window to enroll in Medicare without penalty after your employment or coverage ends (whichever occurs first).

- Moving out of your plan’s service area: You typically have a 2-month window to enroll in a new plan.

- Loss of Medicaid eligibility: You have a 3-month SEP to enroll in Medicare.

Maintain documentation of your qualifying event, as you may need to prove your eligibility for an SEP.

Understand Exceptions to Penalties

Certain situations exempt you from late enrollment penalties:

- Low-income subsidy: Qualification for Extra Help waives Part D penalties.

- Creditable drug coverage: Maintaining creditable prescription drug coverage (such as through an employer plan) can exempt you from Part D penalties.

- Veterans’ benefits: VA health benefits might exempt you from Part D penalties.

- Overseas residence: U.S. citizens living abroad might qualify for penalty-free enrollment upon return.

Document your coverage history meticulously. Keep records of any employer-sponsored health plans, VA benefits, or other coverage that might exempt you from penalties.

Seek Expert Guidance

Medicare enrollment complexities often overwhelm individuals. Consulting with Medicare experts can help you navigate this process effectively. These professionals can provide personalized advice based on your unique circumstances, ensuring you make informed decisions and avoid unnecessary penalties.

Stay Informed About Medicare Changes

Medicare rules and regulations evolve. Try to stay updated on any changes that might affect your enrollment or coverage. Subscribe to official Medicare newsletters, attend informational seminars, or consult with a Medicare specialist regularly to stay informed about potential changes that could impact your coverage or enrollment status.

It’s important to note that Medicare late enrollment penalties can be substantial. For example, in 2025, with a base Part B premium of $185, your monthly premium with the penalty could be $314.50.

Final Thoughts

The Late Enrollment Penalty for Medicare serves as a powerful reminder of the importance of timely enrollment. This penalty can have long-lasting financial implications that affect your healthcare costs for years to come. You can avoid these penalties and ensure seamless healthcare coverage as you transition into retirement by enrolling during your Initial Enrollment Period or qualifying for a Special Enrollment Period.

The complexity of Medicare enrollment and the potential for costly mistakes underscore the value of seeking expert guidance. At Dave Silver Insurance, we specialize in simplifying the Medicare enrollment process. Our team offers personalized advice tailored to your unique health and financial needs.

You should not let confusion or procrastination lead to unnecessary penalties. Take proactive steps to understand your Medicare options and enrollment periods. Medicare is a vital component of your retirement planning (treat it with the same importance as any other major financial decision).