Navigating the world of Medicare can be complex, especially when it comes to understanding supplemental coverage options.

Medigap insurance coverage plays a vital role in filling the gaps left by Original Medicare, providing additional financial protection for seniors.

At Dave Silver Insurance, we’ve seen firsthand how the right Medigap plan can significantly reduce out-of-pocket expenses and offer peace of mind to our clients.

In this post, we’ll break down the essentials of Medigap insurance and help you make an informed decision about your healthcare coverage.

What Is Medigap Insurance?

Defining Medicare Supplement Insurance

Medigap insurance (also known as Medicare Supplement Insurance) fills the gaps in Original Medicare coverage. It provides additional financial protection for seniors, covering out-of-pocket costs that Original Medicare doesn’t pay for.

The Role of Medigap in Healthcare Coverage

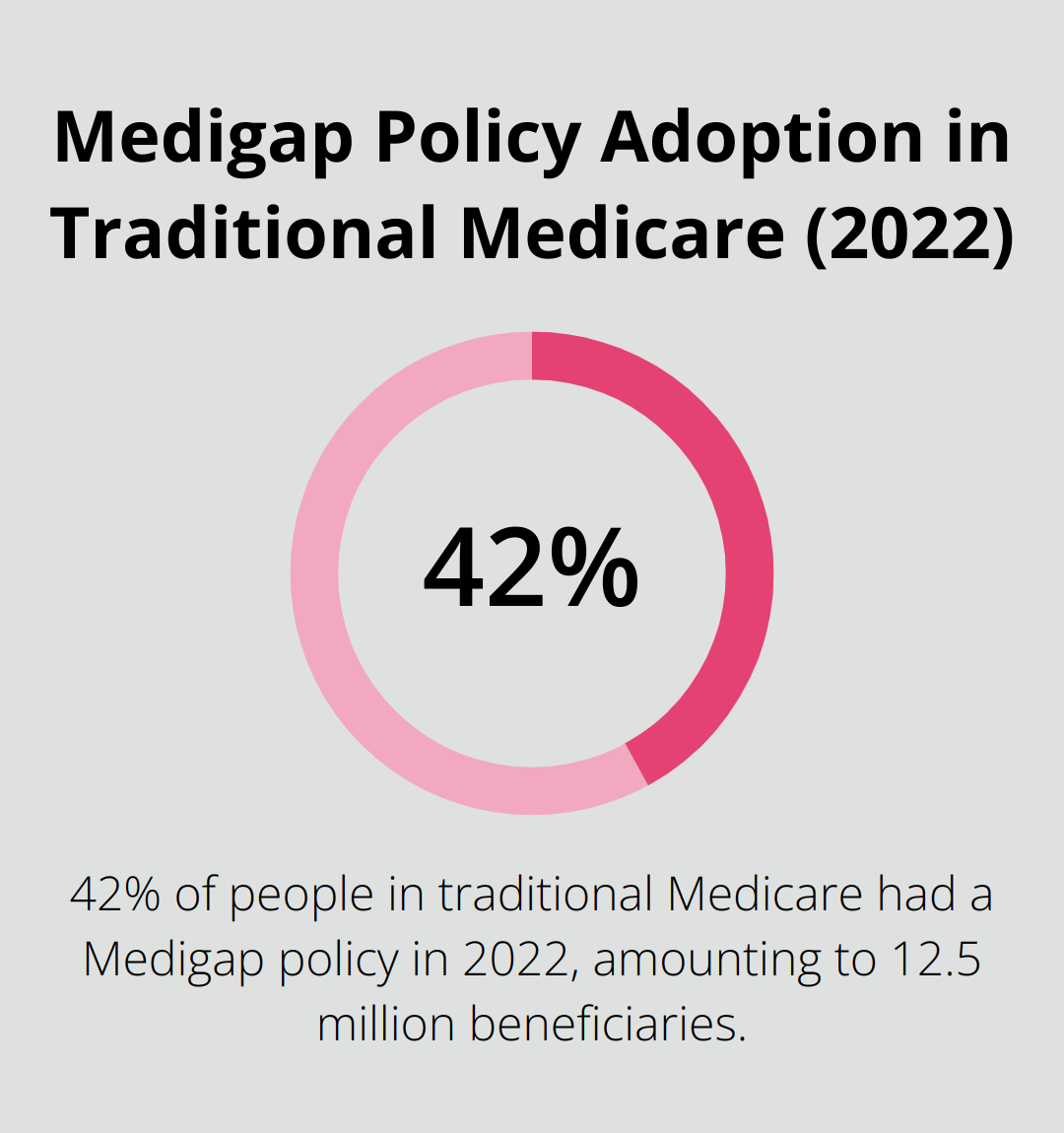

Original Medicare (Parts A and B) covers many healthcare services, but leaves beneficiaries responsible for various expenses. Medigap steps in to help pay for costs like copayments, coinsurance, and deductibles. Four in 10 (42%) people in traditional Medicare had a Medigap policy in 2022, which amounts to 12.5 million beneficiaries.

Distinguishing Medigap from Original Medicare

While the government provides Original Medicare, private insurance companies sell Medigap policies. This distinction affects how you obtain coverage and the range of benefits available. Medigap often offers additional benefits (such as coverage for foreign travel emergencies) that Original Medicare doesn’t provide.

Standardized Plans for Easy Comparison

The federal government has standardized Medigap plans to simplify comparisons for consumers. As of 2023, there are 10 different standardized Medigap plans (labeled A through N). Each plan offers a unique set of benefits, allowing individuals to select coverage that matches their needs and budget.

The Popularity of Plan G

Plan G has become the most popular Medigap option, with 39% of all policyholders (nearly 5.3 million people) enrolled in 2023. Its popularity stems from comprehensive coverage and relatively affordable premiums compared to other high-coverage plans.

The standardization of Medigap plans and the variety of options available highlight the importance of understanding each plan’s benefits. This knowledge empowers seniors to make informed decisions about their healthcare coverage, setting the stage for our next discussion on the key benefits of Medigap coverage.

Why Medigap Coverage Matters

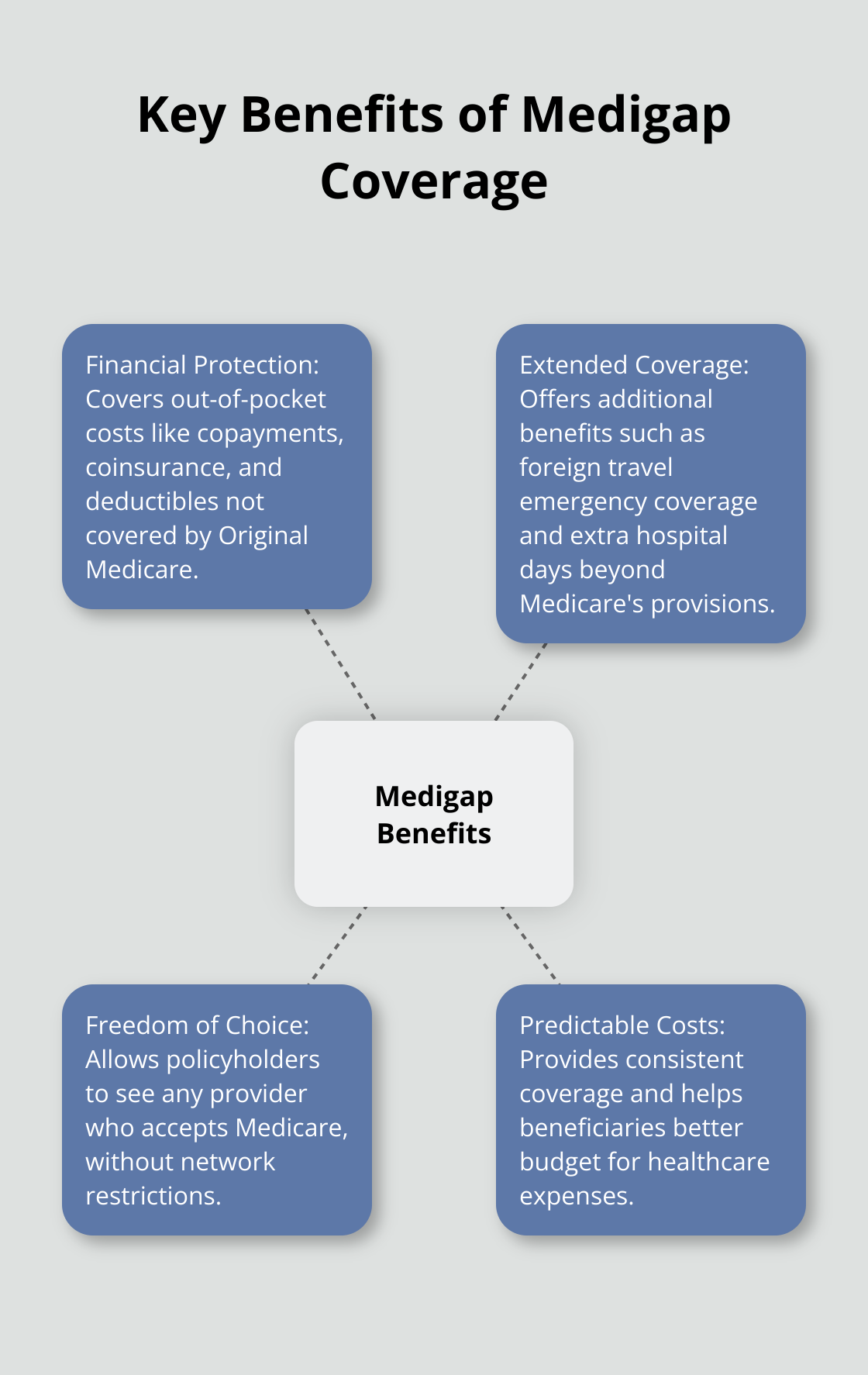

Financial Protection Against High Costs

Medigap plans generally help cover your share of costs for services that are covered by Original Medicare (Part A and Part B). This financial protection proves particularly valuable for seniors on fixed incomes.

Medigap Plan G (the most popular option in 2023) covers the Medicare Part B deductible ($226 in 2023). Policyholders don’t worry about this upfront cost when seeking medical care. Most Medigap plans also cover the 20% coinsurance for Medicare Part B services, which can accumulate quickly for those with chronic conditions or frequent medical needs.

Extended Coverage Beyond Original Medicare

Medigap policies often provide coverage for services not included in Original Medicare. Emergency medical care during foreign travel serves as a prime example. Plans C, D, F, G, M, and N offer foreign travel emergency coverage, paying 80% of billed charges after a $250 deductible. This benefit holds particular value for retirees who enjoy international travel or spend part of the year abroad.

Some Medigap plans also offer additional days of hospital coverage beyond Medicare’s provisions. For instance, after Medicare’s coverage of 150 days for a hospital stay ends, certain Medigap plans continue to pay for an additional 365 days of coverage.

Freedom to Choose Healthcare Providers

Flexibility in choosing healthcare providers emerges as another key advantage of Medigap coverage. Unlike Medicare Advantage plans (which often have network restrictions), Medigap works with any provider who accepts Medicare. Policyholders can see specialists or seek care at facilities across the country without worrying about network limitations.

This flexibility benefits those who split their time between different states or frequently travel within the U.S. It ensures continuity of care and eliminates the need to change doctors or healthcare facilities based on network restrictions.

Moreover, this freedom of choice extends to seeing specialists without referrals. This can lead to faster access to specialized care when needed, potentially improving health outcomes.

Predictable Costs and Peace of Mind

Medigap policies offer predictable healthcare costs, which can provide significant peace of mind. With most plans covering copayments and coinsurance, policyholders can better budget for their healthcare expenses. This predictability proves especially valuable for those managing chronic conditions or anticipating increased medical needs.

For example, a beneficiary with frequent doctor visits or ongoing treatments can avoid unexpected bills each time they receive care. The consistency in coverage allows for better financial planning and reduces stress associated with healthcare costs.

As we explore the various benefits of Medigap coverage, it becomes clear that choosing the right plan requires careful consideration. Let’s examine the factors to consider when selecting a Medigap policy and how to navigate the enrollment process.

How to Select the Best Medigap Plan for You

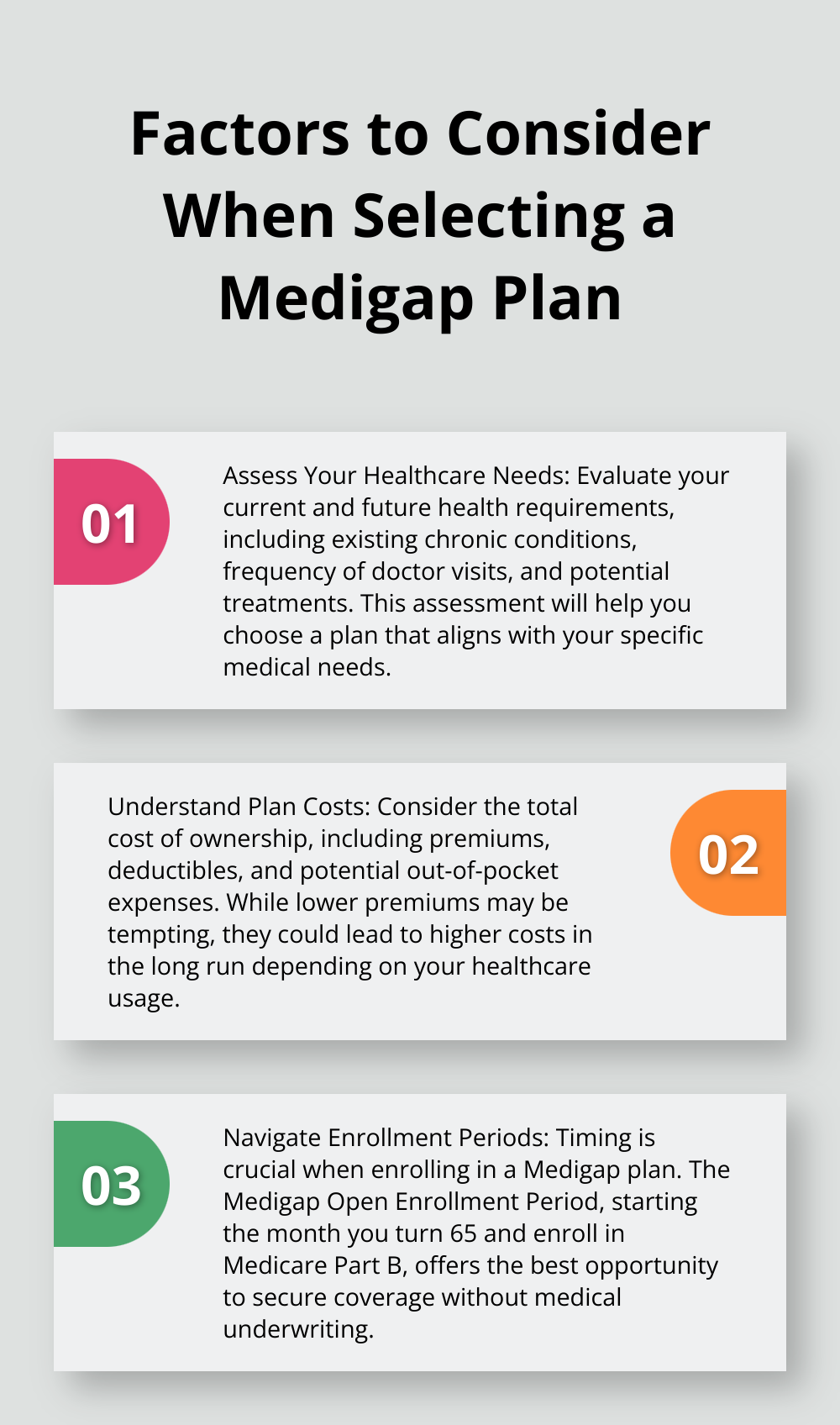

Assess Your Healthcare Needs

The selection of an appropriate Medigap plan requires a thorough evaluation of your current and future health requirements. Consider factors such as existing chronic conditions, the frequency of doctor visits, and potential surgeries or treatments. For example, if you have a condition that necessitates frequent specialist visits, a plan with comprehensive coverage for Part B coinsurance might prove beneficial.

A Kaiser Family Foundation study on Medigap plans revealed that in 2023, average Medigap premiums varied by state and plan type, with some plans costing around $200 per month.

Understand Plan Costs

While the temptation to choose the plan with the lowest premium exists, this approach can lead to unexpected expenses. Consider the total cost of ownership, which includes premiums, deductibles, and potential out-of-pocket expenses. For instance, Plan G has a higher premium than Plan N but covers the Part B excess charges, which could result in savings for those who frequently see doctors who don’t accept Medicare assignment.

Navigate Enrollment Periods

The timing of your enrollment in a Medigap plan plays a critical role. The Medigap Open Enrollment Period, which starts the month you turn 65 and enroll in Medicare Part B, offers the best opportunity to secure coverage without medical underwriting. During this six-month period, insurers cannot deny you coverage or charge higher premiums based on your health status.

Failure to enroll during this window can result in significantly higher premiums or even denial of coverage.

Consider Lifestyle Factors

Your lifestyle and travel habits should influence your Medigap plan selection. If you frequently travel within the U.S. or internationally, you might want to consider a plan that offers coverage for emergency medical care during foreign travel (such as Plans C, D, F, G, M, and N).

Seek Expert Guidance

The complexity of Medigap plans often necessitates expert advice. Insurance professionals can provide valuable insights into the nuances of different plans and help you make an informed decision based on your specific circumstances. They can also assist in navigating the enrollment process and ensure you don’t miss important deadlines.

Final Thoughts

Medigap insurance coverage provides essential financial protection and peace of mind for seniors. These policies fill the gaps left by Original Medicare, offering flexibility in provider choice and additional coverage for services like foreign travel emergency care. The selection of the right Medigap plan requires careful consideration of individual health needs, financial circumstances, and lifestyle factors.

At Dave Silver Insurance, we understand the complexities of Medigap insurance coverage and its importance in your overall healthcare strategy. Our team offers tailored advice to help you select a plan that aligns with your specific health and financial requirements. We simplify the process, provide clear explanations of your options, and guide you through enrollment periods to secure the best possible coverage.

Our personalized approach has earned praise from clients who value our responsiveness and thorough service. We’re available seven days a week to address your questions and concerns, ensuring you feel confident in your healthcare decisions. Whether you’re new to Medicare or considering a change in your supplemental coverage, Dave Silver Insurance will help you navigate the intricacies of Medigap plans with clarity and expertise.