Choosing the right Medigap insurance company can be overwhelming. With numerous options available, it’s crucial to understand what factors to consider when making this important decision.

At Dave Silver Insurance, we’ve helped countless clients navigate the complex world of Medicare supplement plans. In this guide, we’ll walk you through the process of selecting the best Medigap insurance companies for your unique needs and circumstances.

What Is Medigap Insurance?

Understanding Medicare Supplement Insurance

Medigap insurance (also called Medicare Supplement Insurance) plays a key role in comprehensive healthcare coverage for seniors. These policies generally help cover your share of costs for services that are covered by Original Medicare (Part A and Part B). Medigap insurance protects you from potentially high medical expenses.

Types of Medigap Plans

Currently, 10 standardized Medigap plans exist, labeled A through N. Each plan offers different coverage levels, allowing you to select the one that best suits your needs and budget. Plan G, for instance, stands out as one of the most comprehensive options, covering almost all out-of-pocket costs (except for the Medicare Part B deductible).

It’s worth noting that Medigap plans are standardized across insurance companies. This means Plan G from one insurer will offer identical benefits to Plan G from another. However, premiums can vary significantly between companies, highlighting the importance of comparing options.

Medigap and Original Medicare: A Complementary Relationship

Medigap insurance works in tandem with your Original Medicare coverage. When you receive medical services, Medicare pays its portion of the Medicare-approved amount for covered services. Your Medigap policy then pays its share of the remaining costs.

For example, if a doctor’s visit costs $200, Medicare might cover 80% ($160), leaving you with a 20% coinsurance of $40. If your Medigap policy covers this coinsurance, it would pay the remaining $40, resulting in no out-of-pocket cost for that visit.

Selecting the Right Medigap Plan

Your choice of Medigap plan should align with your individual health needs and financial situation. Consider these factors:

- Your anticipated healthcare usage

- Your budget for monthly premiums

- The coverage level you’re comfortable with

We recommend reviewing your healthcare needs annually to ensure your Medigap plan continues to meet your requirements. As your health needs evolve, you might find that a different plan better suits your situation.

The optimal time to enroll in a Medigap plan is during your Medigap Open Enrollment Period, which begins when you’re 65 or older and enrolled in Medicare Part B. During this period, you have guaranteed issue rights, meaning insurance companies can’t deny you coverage or charge you more based on your health status.

As we move forward, let’s explore the key factors to consider when choosing a Medigap insurance company. Understanding these elements will help you make an informed decision and select the best provider for your unique circumstances.

What Matters Most in a Medigap Insurance Company?

Financial Strength and Stability

The financial stability of your chosen insurance company impacts your long-term security. A.M. Best, a credit rating agency specializing in the insurance industry, provides ratings that indicate an insurer’s financial health. Companies with an A rating or higher demonstrate a strong ability to meet ongoing insurance obligations.

Investopedia ranks AARP/UnitedHealthcare as the best Medicare Supplement (Medigap) insurance provider. Other top providers include Anthem and State Farm.

Customer Service Excellence

Quality customer service can transform your Medigap experience. The National Association of Insurance Commissioners (NAIC) offers valuable data on customer complaints for insurance companies. A complaint ratio lower than the national median suggests better-than-average customer service.

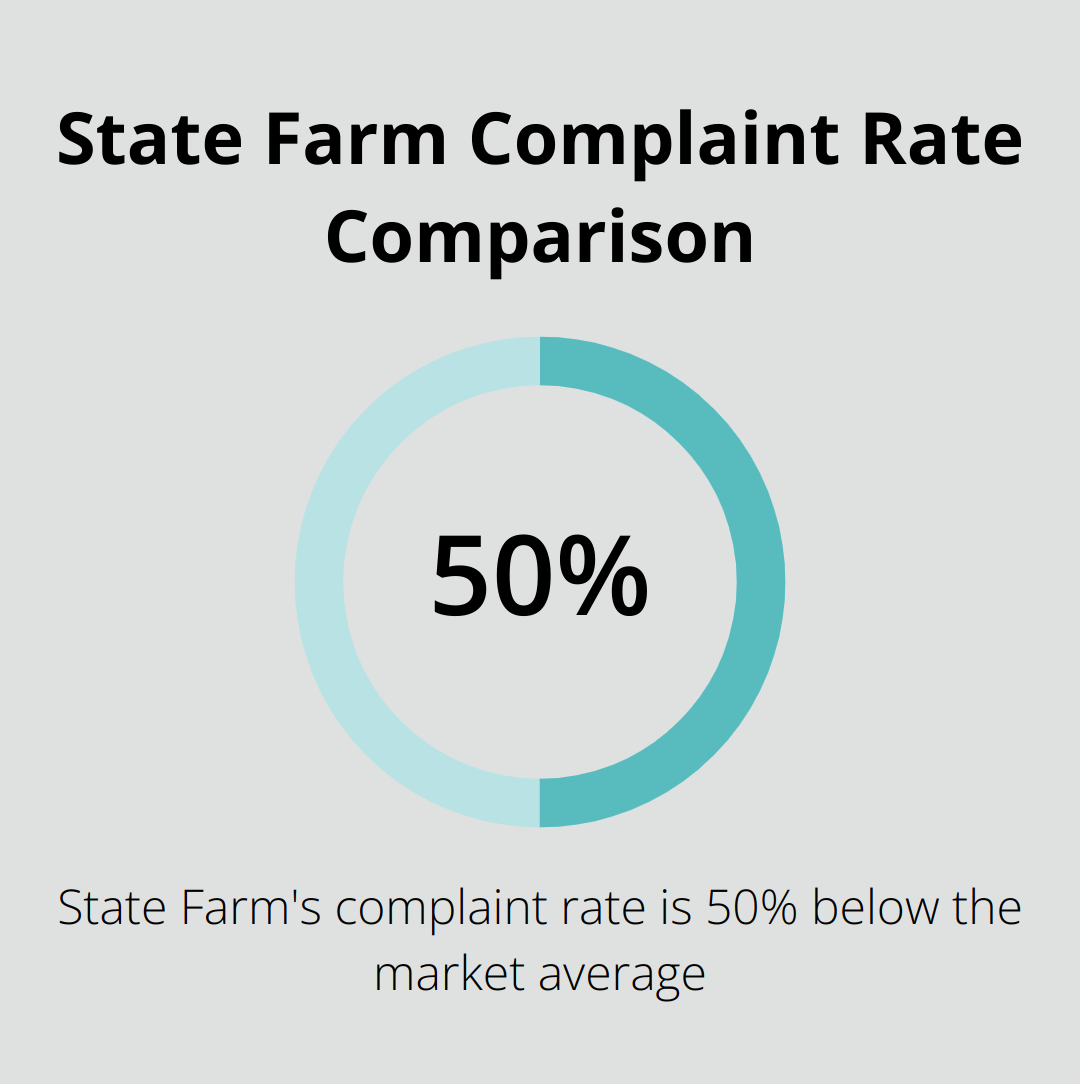

State Farm stands out for its member satisfaction, with complaint rates 50% below the market average. This performance often translates into smoother claim processes and superior overall support.

Comprehensive Plan Availability

While Medigap plans follow standardized guidelines, not all insurance companies offer every plan type in every state. AARP/UnitedHealthcare offers 80% of plan types available across the U.S., providing a wide range of options for beneficiaries.

You should check if the company you consider offers the specific plan you need in your area. Some insurers also provide additional benefits (like dental and vision coverage options), which can enhance your healthcare package.

Premium Costs and Rate Increase History

Initial premium costs matter, but the company’s history of rate increases holds equal importance. Some insurers offer competitive initial rates but implement steep increases over time.

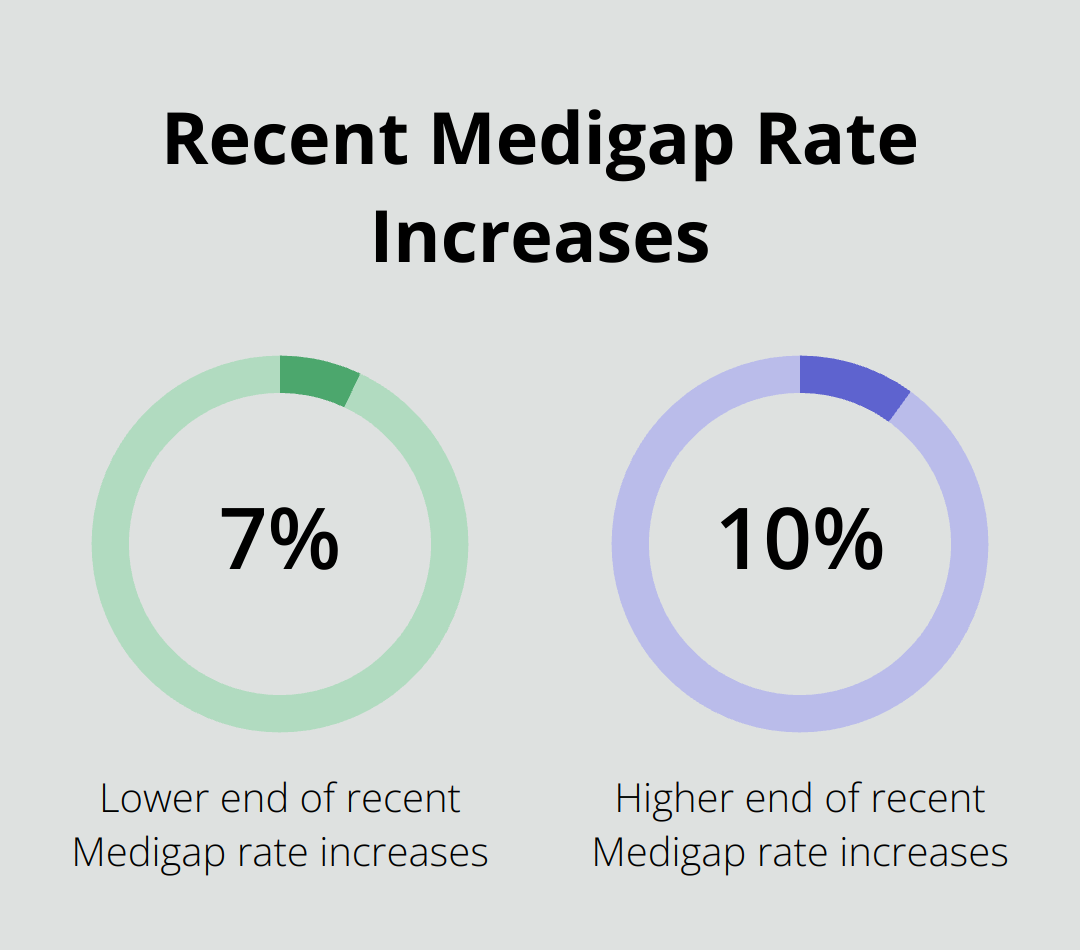

Recent rate increases for Medigap companies have ranged between 7% to 10%. Companies like Mutual of Omaha offer discounts (such as a 12% household discount and a 5% online application discount), which can lead to significant savings over time.

Newer market entrants, such as Allstate and ACE, offer competitive premiums. Allstate, for instance, averages $127 for Plan G, considerably lower than the industry average of $164 in 2023.

When you evaluate costs, consider the pricing method used by the insurer. Community-rated policies, where everyone pays the same regardless of age, may prove more cost-effective in the long run compared to attained-age policies, where premiums increase as you get older.

As you weigh these factors, you’ll find that the best Medicare Insurance plan is one that balances financial stability, customer service quality, plan availability, and cost considerations. In the next section, we’ll explore how to effectively research and compare Medigap insurance companies to make an informed decision.

How to Research Medigap Insurance Companies

Use Online Comparison Tools

Online comparison tools provide a solid starting point for your Medigap research. The Medicare.gov Plan Finder allows you to find Medicare health and drug plans in your area and compare costs. Enter your zip code to get started and see a side-by-side comparison of available options.

NerdWallet’s Medigap comparison tool offers ratings for various Medigap providers based on factors like pricing, discounts, plan types, and complaint data. This tool helps narrow down your options to the most reputable and cost-effective providers.

Consult Independent Insurance Agents

While online tools offer valuable information, personalized advice from experienced professionals proves invaluable. Independent insurance agents can explain the nuances of different plans, help you understand how your health needs align with various coverage options, and assist with the enrollment process.

Independent agents work with multiple insurance companies, providing a broader perspective on available options. They can also help you navigate complex situations (such as switching plans outside of the open enrollment period).

Read Customer Reviews and Testimonials

Customer experiences offer valuable insights into an insurance company’s performance. Look for reviews on independent review sites, consumer forums, and social media platforms. Pay attention to comments about customer service, claim processing speed, and overall satisfaction.

Approach online reviews with a critical eye. Look for patterns in feedback rather than focusing on individual experiences. People tend to leave reviews when they’ve had extremely positive or negative experiences, which might not represent the average customer experience.

Verify Complaint Ratios with State Insurance Departments

Every state has an insurance department that regulates insurance companies and handles consumer complaints. These departments often publish complaint ratios for insurance companies operating in their state. A low complaint ratio indicates that the company has fewer complaints relative to its size.

The National Association of Insurance Commissioners (NAIC) provides a complaint index for insurance companies. A score of 1.0 represents the national median, with lower scores indicating fewer complaints. State Farm, for instance, has a complaint rate 50% below the market average, which strongly indicates customer satisfaction.

Final Thoughts

Selecting the best Medigap insurance companies requires careful consideration of financial stability, customer service excellence, plan availability, and premium costs. Thorough research will help you make an informed decision. Use online comparison tools, consult independent insurance agents, read customer reviews, and verify complaint ratios with state insurance departments.

Your unique health needs, budget, and preferences should drive your decision when choosing a Medigap provider. What works best for one person may not be ideal for another. The right company will offer a balance of financial strength, customer satisfaction, comprehensive plan options, and competitive pricing.

We at Dave Silver Insurance understand the complexities of choosing the right Medigap plan and provider. With over 17 years of experience in Medicare enrollment, we offer personalized guidance tailored to your specific situation. Schedule a consultation with Dave Silver Insurance for expert advice that considers your individual health and financial needs.